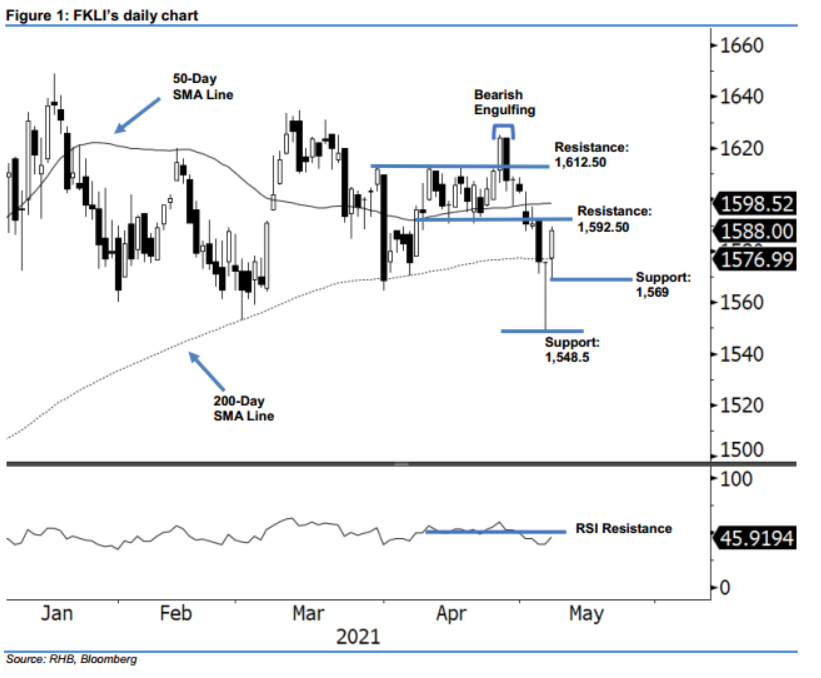

FKLI - Strong Reversal Above 200-day SMA Line

rhboskres

Publish date: Mon, 10 May 2021, 09:56 AM

Trailing-stop triggered; initiate long positions. The FKLI reversed on strong bullish momentum after it climbed 12.5 pts to close at 1,588 pts last Friday. It formed a “morning doji star” pattern, indicating the start of an uptrend. The index opened at 1,577.5 pts, then touched the low of 1,569 pts before trending north towards the high of 1,589.5 pts. The emergence of a bullish momentum last Friday was in line with the previous day’s reversal signal. This points to a high probability of the index extending the positive momentum, as it heads towards the 50-day SMA line before attempting to cross the 1,600-pt psychological level again. Since the FKLI closed above the trailing-stop set earlier, we switch over to a positive trading bias.

We closed out the short positions initiated at the close of 30 Apr (1,595 pts), after triggering the trailing-stop above the 1,580-pt level. Conversely, we initiate long positions at the close of 7 May, at 1,588 pts. To manage risks, we set the initial stop-loss below 1,569 pts, which is also 7 May’s low.

The support levels are revised at 1,569 pts – which is 7 May’s low – and 1,548.5 pts (6 May’s low). Towards the upside, the resistance levels revised to 1,592.50 pts – 5 May’s high then 1,612.5 pts (30 Mar’s high).

Source: RHB Securities Research - 10 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024