FCPO - Profit-Taking Near Record High

rhboskres

Publish date: Tue, 11 May 2021, 09:56 AM

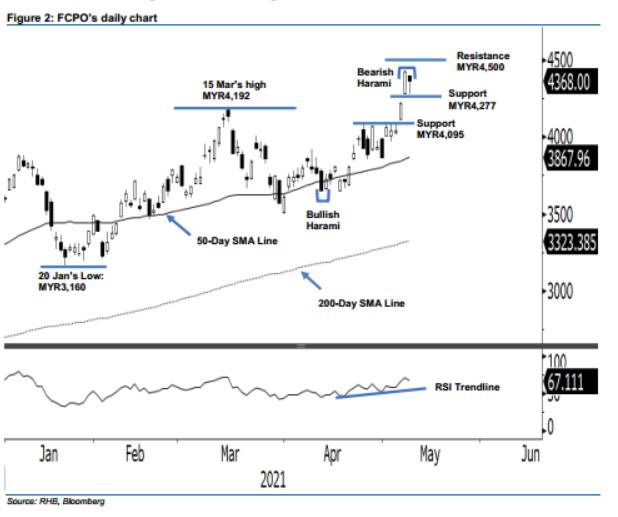

Maintain long positions. The FCPO’s recent rally took a pause after settling MYR59.00 lower (from the all-time high’s closed) yesterday. The commodity opened at MYR4,398 then dragged down to touch the day’s low of MYR4,281, before it bounced off to close at MYR4,368. This pointed to a “Bearish Harami” pattern, indicating profit-taking activities in the immediate term, before it could resume its upward movement. If the negative momentum follows through in the coming sessions – thereby breaching the MYR4,277 level – it may correct further to MYR4,095. Otherwise, it may consolidate sideways. While the trailing stop has not been triggered yet, we stick to a positive trading bias.

We suggest that traders stay in long positions. We initiated these at the close of 3 May, or MYR4,061. To manage risks, the trailing-stop is maintained at MYR4,277 (7 May’s low).

The immediate support levels remain unchanged at MYR4,277 (7 May’s low), followed by MYR4,095. Towards the upside, the resistance levels are still at the psychological levels of MYR4,500 and MYR4,580.

Source: RHB Securities Research - 11 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024