WTI Crude - Retesting the USD64.00 Psychological Level

rhboskres

Publish date: Tue, 11 May 2021, 10:05 AM

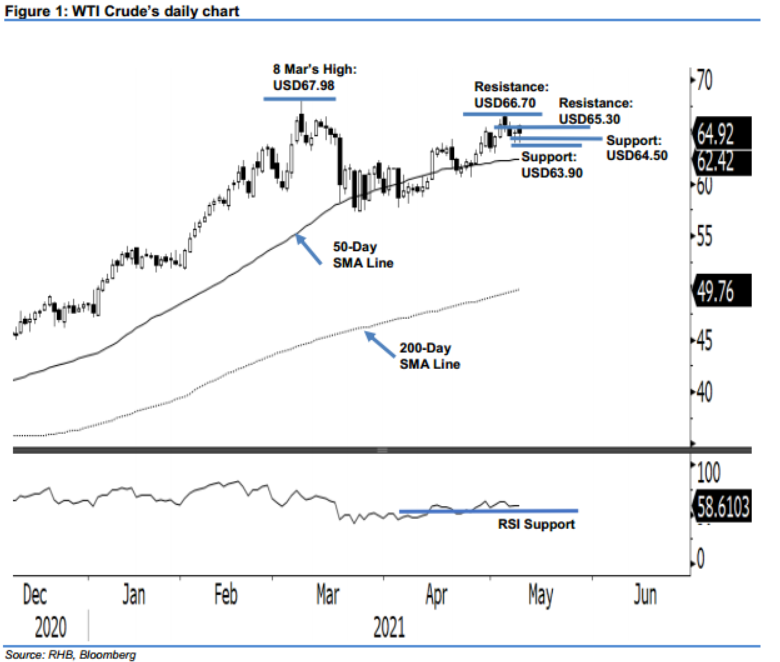

Maintain long positions. The WTI Crude retested the USD64.00 psychological level yesterday, rising by a marginal USD0.02 to settle at USD64.92. During the first trading session of the week, the commodity gapped up to start at USD65.57. After touching the day’s high of USD65.75, it drifted lower to test the low of USD63.95. Strong buying interest emerged near the USD64.00 level, sending it higher to close at USD64.92. The latest price action shows that the bulls are defending the USD64.00 psychological level. A breach below this level may trigger a correction towards the 50-day SMA line. However, if it can stay above the USD63.90 support level, a “higher low” bullish pattern will be established. As the trailing-stop remains intact, we keep our positive trading bias.

We recommend traders maintain the long positions initiated at USD63.86, or the closing level of 28 Apr. To manage risks, the trailing-stop is set at USD64.00.

The nearest support is marked at USD64.50, followed by USD63.90 – the low of 7 May. The immediate resistance remains at USD65.30, followed by the USD66.70 round figure.

Source: RHB Securities Research - 11 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024