FCPO - Moving Sideways

rhboskres

Publish date: Wed, 12 May 2021, 05:04 PM

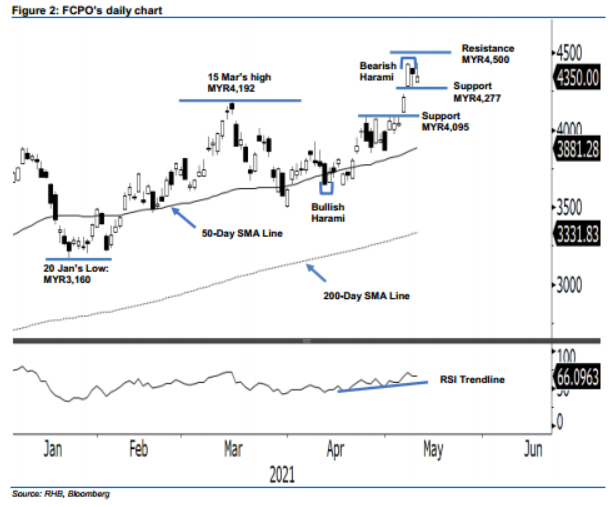

Maintain long positions. The FCPO continued its pause, following the recent rally, settling MYR18.00 lower at MYR4,350 yesterday – above the immediate support level. The commodity started the session lower, with a gap down to MYR4,315, and tapped the low of MYR4,309 before bouncing off towards the high of MYR4,434. It then retraced from the high to end the session. It attempted to cross the recent all-time-high, but retraced sharply in the evening session – indicating mixed momentum. With the RSI level remaining above 60%, coupled with the immediate support remaining firm, the commodity is expected to move sideways above the support level in the immediate term. As the trailing-stop has not been triggered yet, we maintain our positive trading bias.

We suggest that traders remain in long positions. We initiated these at the close of 3 May, or MYR4,061. To manage risks, the trailing-stop is set at MYR4,277, which was 7 May’s low.

The immediate support levels are maintained at MYR4,277 or 7 May’s low, followed by MYR4,095. Towards the upside, the resistance levels stay at the psychological levels of MYR4,500 and MYR4,580.

Source: RHB Securities Research - 12 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024