E-Mini Dow - Bearish Momentum Extended

rhboskres

Publish date: Wed, 12 May 2021, 05:05 PM

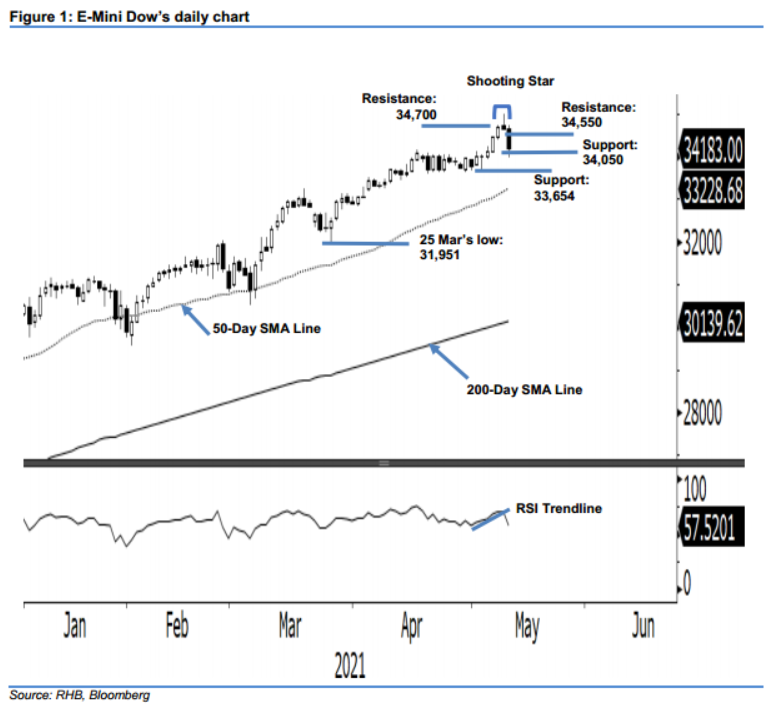

Trailing stop triggered; initiate short positions. The E-Mini Dow saw profit-taking activities extend yesterday, falling 485 pts to settle at 34,183 pts. Following the Shooting Star at the top, it started Tuesday’s session weaker at 34,647 pts. After testing the session high at 34,732 pts, selling pressure dragged the index towards the 33,983- pt session low. It closed at 34,183 pts, breaching the previous 34,550-pt support level. Since the RSI indicator is also breaking below the trendline, it is very likely that the bearish momentum will persist in the coming sessions, which should then see the E-Mini Dow pull back towards the 34,000-pt psychological level, or – at least – re-test the support level of 34,050 pts. After the trailing stop was breached, we changed to a negative trading bias.

We closed out the long positions initiated at 31,509 pts, ie the closing level of 1 Mar. Conversely, we initiate short positions at 34,183 pts, which was the closing level of 11 May. For risk-management purposes, the initial stop loss is placed at 34,800 pts.

The immediate support is revised to 34,050 pts and followed by 33,654 pts. On the upside, the immediate resistance is revised to 34,550 pts, followed by 34,700 pts.

Source: RHB Securities Research - 12 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024