E-Mini Dow - Mild Selling Pressure Emerges

rhboskres

Publish date: Tue, 18 May 2021, 10:13 AM

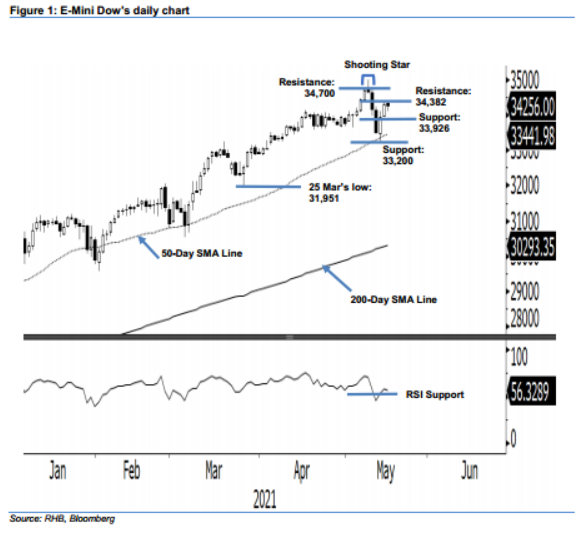

Maintain short positions. The E-Mini Dow saw the recent rebound taking a pause yesterday, retreating 62 pts to settle at 34,256 pts. On Monday, it started the session flat at 34,320 pts, testing the session high at 34,374 pts. The index then pulled back to touch the session low at 34,093 pts before concluding the session at 34,256 pts. After strong rallies over the last two sessions, the bulls decided to trim positions and take profits. Meanwhile, the bulls are also hesitating to cross the 34,382-pt immediate resistance – anticipating stronger selling pressure emerging near 34,700 pts. The E-Mini Dow may consolidate sideways before launching an attempt to cross the immediate resistance. If the current profit-taking activities extend, the index may turn lower to retest the 34,000-pt psychological level again. Meanwhile, we stick to a negative trading bias until the stop-loss level is breached.

We recommend traders keep to the short positions initiated at 34,183 pts, or the closing level of 11 May. For risk management purposes, the stop loss can be set above 34,700 pts.

The immediate support is marked at 5 May’s low of 33,926 pts, followed by 13 May’s 33,200-pt low. On the upside, the immediate resistance is revised to 34,382 pts – the next hurdle is pegged at 34,700 pts.

Source: RHB Securities Research - 18 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024