WTI Crude - Crossing Above USD66.00

rhboskres

Publish date: Tue, 18 May 2021, 10:13 AM

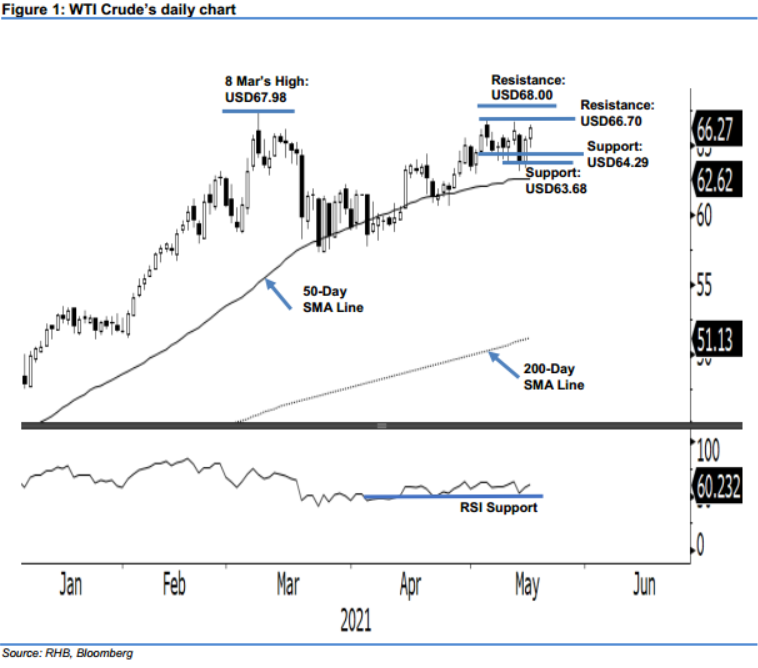

Maintain short positions. The WTI Crude extended its rebound yesterday, rising USD0.90 to settle at USD66.27. It initially opened at USD65.50, then dipped to the session low of USD64.83, before strong demand lifted it towards the USD66.43 session high. It closed the session at USD66.27, ie USD0.03 marginally lower than the initial stop loss of USD66.30. The commodity is on track to trend higher after breaching the previous resistance of USD65.81. It is in the midst of forming a “higher high” bullish pattern. Although the WTI Crude is shifting back towards a bullish momentum, the stop loss remains intact. Hence, we maintain a negative trading bias.

Traders are advised to maintain short positions initiated at USD63.82, or the closing level of 13 May. To manage risks, the initial stop-loss level is placed at USD66.30.

The nearest support is maintained at USD64.29, ie 4 May’s low, and followed by USD63.68 – the low of 11 May. The immediate resistance is revised to USD66.70, followed by the USD68.00 round figure.

Source: RHB Securities Research - 18 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024