FCPO - Gap Down Knocks Off The Bulls

rhboskres

Publish date: Tue, 18 May 2021, 10:16 AM

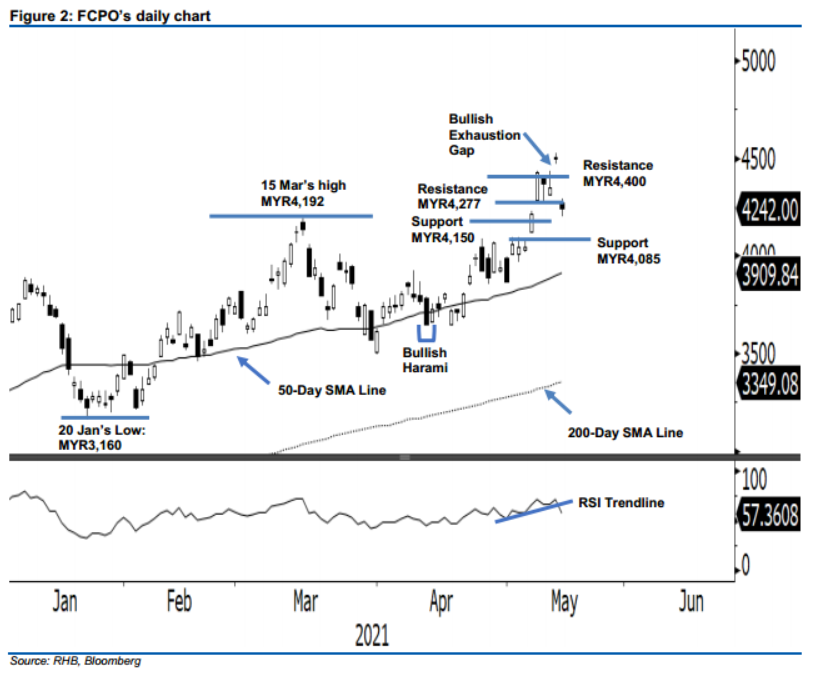

Trailing stop triggered; initiate short positions. The FCPO gapped down, breaking below the support and trailing stop levels to close weaker at MYR4,242 during latest session. The Aug 2021 futures contract started the session with a bearish sentiment at MYR4,270 – trading in a range between the low of MYR4,203 and the high of MYR4,292 before closing near to its opening. Contrary to the recent “bullish exhaustion gap”, the commodity showed a gap down during the latest session, offsetting the bullish momentum that occurred earlier. With this, the selling pressure is obvious, which draws an expectation of a bearish momentum occurring in the upcoming sessions. With the RSI level dropping from 70% to below 60% in one session, it strengthens the argument that a negative momentum is taking place. Since the trailing stop has been triggered, we change from positive to a negative trading bias.

We closed out the long positions, which were initiated at the close of 3 May at MYR4,061, after the trailing-stop was triggered at MYR4,400. Conversely, we initiate short positions at the closing level of 17 May. To manage risks, a stop loss can be placed above MYR4,400.

The immediate support level is revised at MYR4,150, followed by MYR4,085 or the high of 5 May. Towards the upside, the resistance levels are revised at 7 May’s low of MYR4,277 and subsequently MYR4,400 – the psychological level.

Source: RHB Securities Research - 18 May 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024