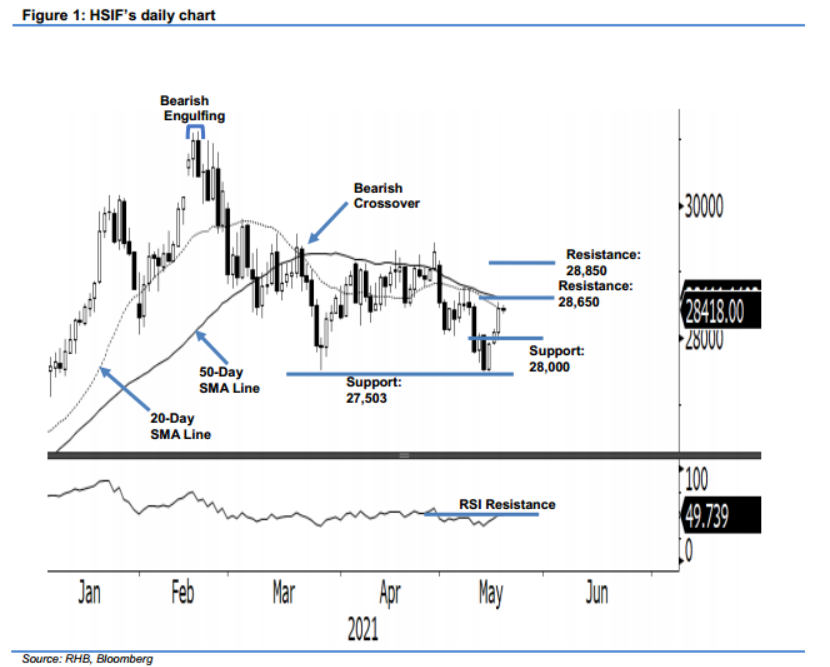

Hang Seng Index Futures - Testing the 20-Day SMA Line

rhboskres

Publish date: Wed, 19 May 2021, 09:11 AM

Maintain short positions. The HSIF saw bullish momentum lifting it towards the 20-day SMA line after adding 364 pts to settle the day session at 28,454 pts – this marked the third consecutive positive session since the rebound from May’s low. It initially started Tuesday’s session at 28,260 pts but, not long later, the index jumped to the 28,528-pt day high and stayed sideways for the rest of the day session. Mild profit-taking took place during the evening session, which saw the HSIF closing 36 pts lower at 28,418 pts. As mentioned in our previous note, we do expect selling pressure to persist near the 20-day SMA line. Crossing above the moving average may see a trend change. However, turning lower from the moving average will see the index failing to break above the 28,650-pt resistance level – forming another “lower high” bearish pattern. We stick to our negative trading bias until the stop loss is breached.

We recommend traders hold on to the short positions initiated at the closing level of 3 May’s day session, ie 28,133 pts. For risk-management purposes, the stop-loss level is set at 28,750 pts.

The immediate support marked at the 28,000-pt pyschological level and followed by March’s low of 27,503 pts. Conversely, the immediate resistance is set at 28,650 pts and followed by 28,850 pts.

Source: RHB Securities Research - 19 May 2021