WTI Crude - Pulling Back to Re-Test the Support Level

rhboskres

Publish date: Wed, 19 May 2021, 09:11 AM

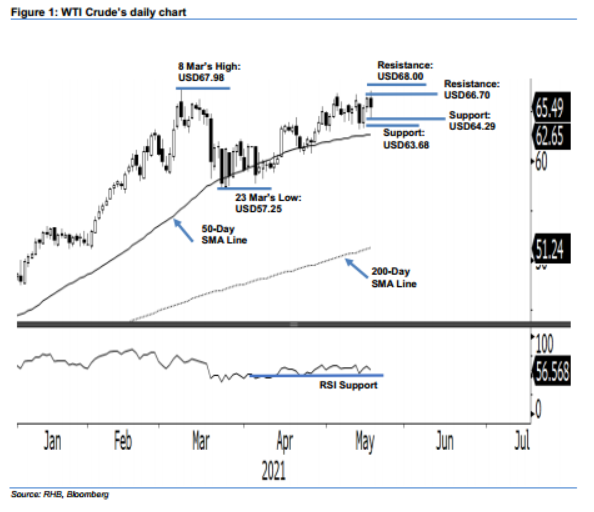

Maintain short positions. The WTI Crude’s recent rebound was blocked by the resistance, where the bullish momentum fizzled – the commodity pulled back USD0.78 to settle at USD65.49. It initially opened stronger on Tuesday at USD66.33 and rose to the session high of USD67.01. However, sentiment turned cautious during the European trading hours, where the WTI Crude dropped to the USD64.11 session low before paring its losses to close at USD65.49. This showed that the black gold may move sideways again for consolidation purposes before it can re-test the USD66.70 resistance. While moving horizontally, we expect mild buying interest to emerge near the USD64.29 support level. Since the stop loss stays intact, we retain our negative trading bias.

Traders should keep to the short positions initiated at USD63.82, or the closing level of 13 May. To manage risks, the initial stop-loss level is set at USD66.30.

The nearest support is marked at USD64.29 – 4 May’s low – and followed by USD63.68, or the low of 11 May. The immediate resistance is pegged at USD66.70 and followed by the USD68.00 round figure.

Source: RHB Securities Research - 19 May 2021