FKLI - Testing The Immediate Resistance

rhboskres

Publish date: Tue, 17 Aug 2021, 09:55 AM

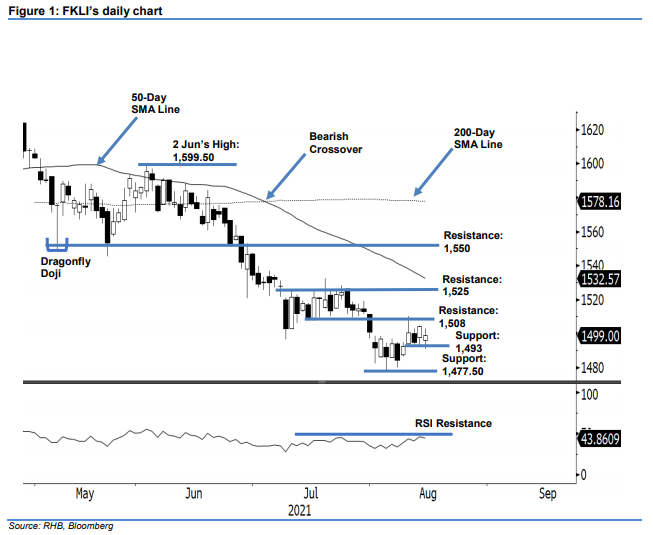

Maintain short positions. The FKLI pulled back lower yesterday, bouncing off the support level to close at 1,499 pts and declining 5 pts from the previous session. It started Monday’s session weaker at 1,496 pts. Strong selling pressure was seen during the early session where the index fell to the 1,491-pt day low before rebounded mildly. At one point during the afternoon session, the index jumped to test the intraday high of 1,503 pts. However, the momentum failed to sustain and saw the index retrace to close at 1,499 pts. Although the RSI is trending higher, with the bullish momentum building up, the indicator has yet to cross the 50% threshold. Expect the FKLI to consolidate along the immediate support level in the coming sessions. If the momentum falters, the index may drop below the 1,493-pt support level. As of now, we still stick to our negative trading bias until the immediate resistance is breached.

Traders are recommended to stay in short positions, which we initiated at 1,569.50 pts, or 11 Jun’s close. To control the trading risks, the trailing-stop is set at 1,508 pts, or the immediate resistance level.

The immediate support established at 1,493 pts, or the low of 11 Aug, followed by 1,477.50 pts or the low of 4 Aug. Conversely, the immediate resistance is kept at 1,508 pts – the low of 14 Jul, then 1,525 pts or 9 Jul’s high.

Source: RHB Securities Research - 17 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024