E-Mini Dow - Bouncing Off the Support With Strong Momentum

rhboskres

Publish date: Tue, 17 Aug 2021, 09:57 AM

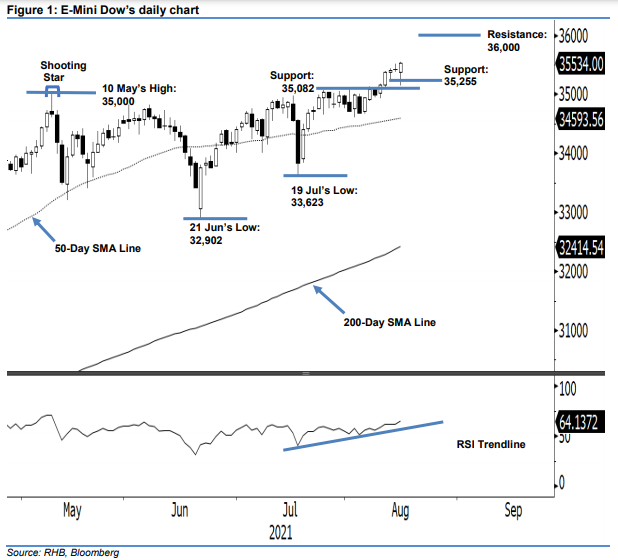

Maintain long positions. After paring most of its intraday losses, the E-Mini Dow closed 114 pts higher at 35,534 pts – recording a new high. The index began with a negative tone at 35,383 pts before gradually moving lower towards the beginning of the Asian trading hours. It then consolidated below the opening until a strong selling momentum brought the E-Mini Dow lower towards the day’s bottom of 35,146 pts. During the US trading hours, strong positive momentum uplifted it from bottom to the day’s peak of 35,547 pts just before the conclusion of a volatile session. The white body with long lower shadow candlestick negated the previous Shooting Star pattern, signifying the continuation of the bullish momentum and on track to record a fresh high. The positive price action was also supported by the technical strength of the RSI, which is now above the 60% level. To account for the increased volatility, we lower our trailing stop to the latest immediate support level. Unless the momentum is reversed and breaches the trailing-stop level, we stick to our positive trading bias.

Traders should maintain the long positions initiated at 35,091 pts, or the closing level of 6 Aug. To manage the trading risks, the trailing-stop threshold is adjusted to 35,255 pts – 12 Aug’s low – or the latest immediate support.

The immediate support level is shifted to 35,255 pts, ie 12 Aug’s low, and followed by 35,082 pts – 2 Aug’s high. The resistance levels are set at 36,000 pts and 36,500-pt – both are round numbers.

Source: RHB Securities Research - 17 Aug 2021