Hang Seng Index Futures - Testing the 26,000-Pt Psychological Level

rhboskres

Publish date: Tue, 17 Aug 2021, 09:58 AM

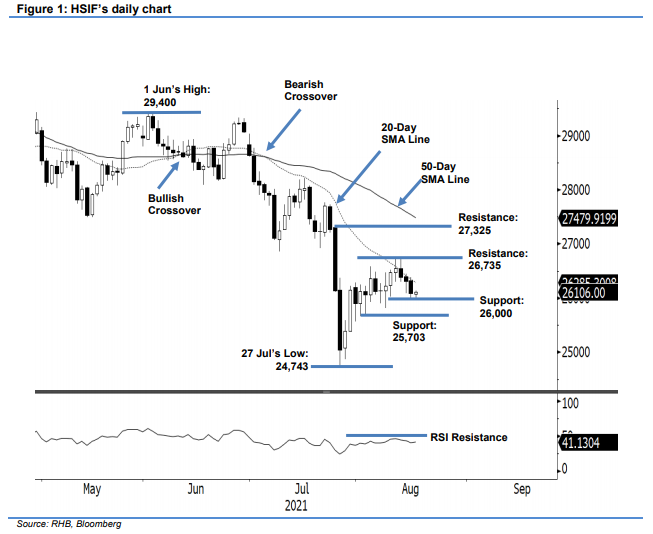

Maintain long positions. The HSIF continues to be capped by the 20-day SMA line, as it retreated 222 pts to settle the day session at 26,088 pts. On the first trading day of the week, it initially started stronger at 26,361 pts. It staged a brief rebound to touch the 26,380-pt day high, but the momentum during the early session failed to sustain – it fell lower throughout the session and reached the 25,988-pt day low before the close. The bears took a breather during the evening session where the index recouped 18 pts and last traded at 26,106 pts. Since printing the 26,735-pt day high on 12 Aug, the HSIF has been moving on “lower highs” for two consecutive sessions. As it is consolidating beneath the 20-day SMA line, we will monitor the reaction near 26,000 pts. Sentiment will remain optimistic should it withstand above the psychological level. Hence, we retain our positive trading bias until this threshold is breached.

Traders should maintain the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To mitigate the downside risks, the stop-loss threshold is set at 26,000 pts.

The immediate support is established at the 26,000-pt psychological level, followed by 25,703 pts, ie 3 Aug’s low. The nearest resistance is sighted at 26,735 pts – 12 Aug’s high – and followed by 27,325 pts, or 26 Jul’s high.

Source: RHB Securities Research - 17 Aug 2021