E-Mini Dow - The Bears Breach the Immediate Support

rhboskres

Publish date: Thu, 19 Aug 2021, 05:55 PM

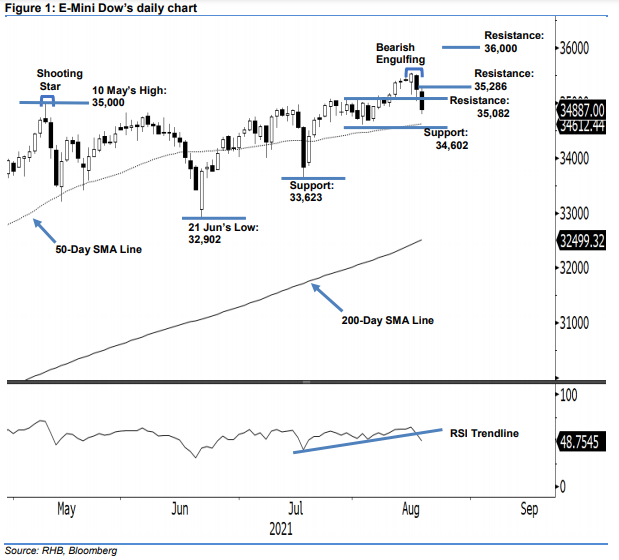

Stop loss triggered; initiate short positions. The E-Mini Dow continued to fall further yesterday by closing 372 pts lower at 34,887 pts – breaching below its immediate support level. It began lower with a gap at 35,212 pts and then whipsawed in a sideways direction until the mid-US trading hours – tapping its day high of 35,286 pts. However, strong selling pressure emerged towards the end of the session, which saw the index fall towards the day’s bottom of 34,790 pts before its close. The black body candlestick that printed for two consecutive sessions – while breaching its trailing-stop level of 35,255 pts – suggests the bears are back in control. This negative price action is also supported by the weaker RSI strength – from above to below the 50% level – which negated the previous positive strength trendline. Since the trailing stop has breached, we shift our positive trading bias to a negative one.

We closed out the long positions initiated at 35,091 pts, or the closing level of 6 Aug, after the trailing-stop level at 35,255 pts was triggered. Conversely, we initiate short positions at the closing level of 18 Aug at 34,887 pts. To mitigate the trading risks, the initial stop-loss level is set at 35,286 pts, or 18 Aug’s high.

The immediate support level is pegged at 33,623 pts, or 19 Jul’s low, and followed by 32,902 pts – 21 Jun’s low. The resistance levels are marked at 35,082 pts – 2 Aug’s high – and 35,286 pts, ie 18 Aug’s high.

Source: RHB Securities Research - 19 Aug 2021