COMEX Gold - Struggling Near the 20-Day SMA Line

rhboskres

Publish date: Thu, 19 Aug 2021, 05:55 PM

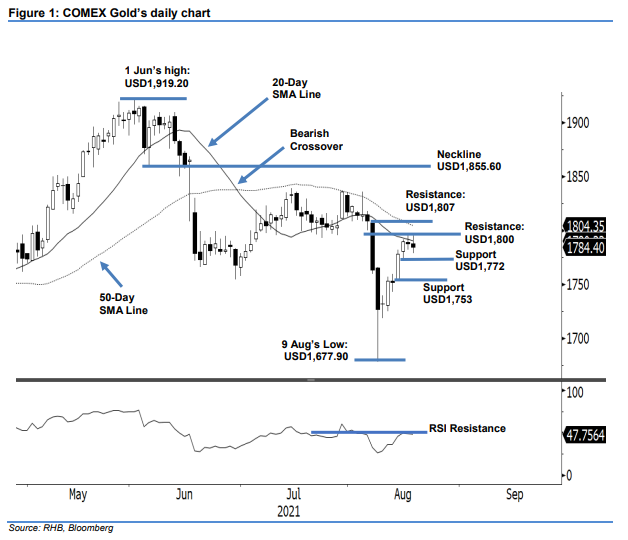

Maintain long positions. The COMEX Gold extended its pause near the 20-day SMA line, pulling back USD3.40 to close at USD1,784.40 yesterday. The commodity started weaker at USD1,787.80. After gyrating between USD1,795.70 and USD1,778.80, it ended the lacklustre session at USD1,784.40. The fresh neutral candlestick showed that both bulls and bears were still adopting wait-and-see approaches. However, the 20-day SMA line is trending lower, and this may drag the COMEX Gold down if the momentum failed to regain its strength. We expect the USD1,772 level to provide strong support in the event selling pressure increases in the coming sessions. As the stop-loss level remains intact, we make no changes to our positive trading bias.

Traders should stick to the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For risk management, the stop-loss mark is pegged at USD1,760.

The immediate support is set at USD1,772 – 16 Aug’s low – and followed by USD1,753, ie the low of 13 Aug. The immediate resistance is unchanged at the USD1,800 psychological level and followed by the USD1,807 mark, or 6 Aug’s high.

Source: RHB Securities Research - 19 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024