Hang Seng Index Futures - Testing the Immediate Support Level

rhboskres

Publish date: Fri, 20 Aug 2021, 05:43 PM

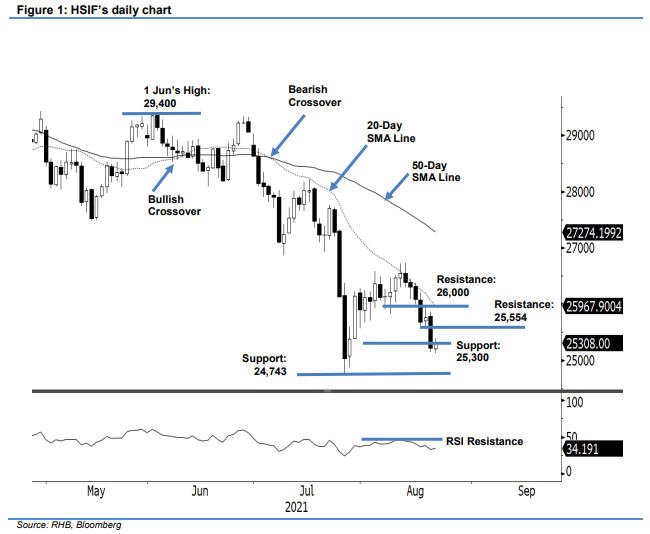

Maintain short positions. The HSIF took a beating yesterday, plunging 544 pts to settle the day session at 25,213 pts. The index opened at 25,757 pts on Thursday. Following a jittery sentiment, it progressed lower on huge selling pressure, touching the 25,144-pt day low just before the close. Mild buying pressure during the evening session lifted the HSIF back towards 25,300-pt territory – it closed at 25,308 pts. If the selling pressure tapers, the bulls may able to build an interim base near 25,300 pts. Otherwise, breaching the immediate support will see the index travel southwards to test the 24,743-pt level, ie 2021’s low. As the RSI is staying below the 50% threshold, we expect immediate-term consolidations below the resistance level. As the HSIF has been printing “lower highs” bearish patterns lately, we maintain our negative trading bias until the pattern changes.

We advise traders maintain short positions where we initiated, ie 25,683 pts, or the closing level of 17 Aug. To mitigate the trading risks, the initial stop-loss threshold is placed at 26,450 pts.

The immediate support remains at the 25,300-pt round figure and followed by 24,743 pts, ie 27 Jul’s low. The immediate resistance is eyed at 25,554 pts – 18 Aug’s low – and followed by the 26,000-pt psychological level.

Source: RHB Securities Research - 20 Aug 2021