E-Mini Dow- Bouncing Off the 50-Day SMA Line

rhboskres

Publish date: Mon, 23 Aug 2021, 11:21 AM

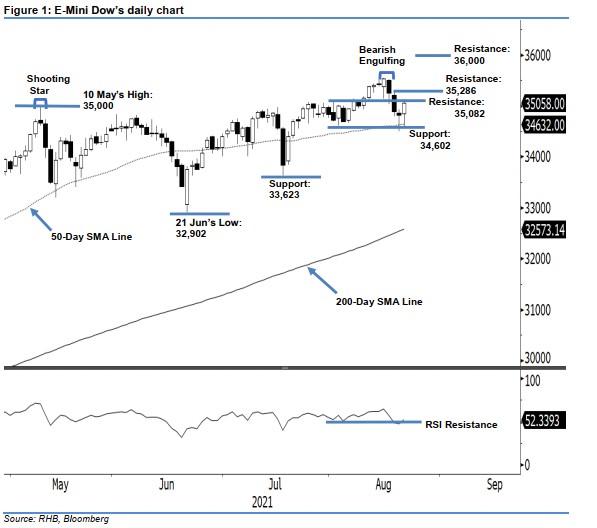

Maintain short positions. After three consecutive bearish sessions, the E-Mini Dow bounced off from its intraday low to tap its immediate resistance last Friday, closing 240 pts higher at 35,058 pts. It began with a positive tone at 34,847 pts, but selling pressure emerged to led the index southwards throughout the Asian trading hours – it hit the day’s bottom of 34,569 pts. However, buying pressure then kicked in during the European trading hours, which saw the E-Mini Dow tap the 35,058-pt day high before the close. The white body candlestick with long lower shadow printed yesterday suggests the index may have found its footing near the 50-day SMA line – in line with our recent expectation of a mild rebound happening in the immediate sessions. The medium-term bullish sign will only be established if it manages to print another bullish candle above the 35,286-pt stop-loss level. Despite the RSI rebounding slightly above the 50% level, it is still premature to conclude a medium-term strength. Until the momentum reverses to trigger the stop-loss level, we stick to our negative trading bias.

Maintain short positions. After three consecutive bearish sessions, the E-Mini Dow bounced off from its intraday low to tap its immediate resistance last Friday, closing 240 pts higher at 35,058 pts. It began with a positive tone at 34,847 pts, but selling pressure emerged to led the index southwards throughout the Asian trading hours – it hit the day’s bottom of 34,569 pts. However, buying pressure then kicked in during the European trading hours, which saw the E-Mini Dow tap the 35,058-pt day high before the close. The white body candlestick with long lower shadow printed yesterday suggests the index may have found its footing near the 50-day SMA line – in line with our recent expectation of a mild rebound happening in the immediate sessions. The medium-term bullish sign will only be established if it manages to print another bullish candle above the 35,286-pt stop-loss level. Despite the RSI rebounding slightly above the 50% level, it is still premature to conclude a medium-term strength. Until the momentum reverses to trigger the stop-loss level, we stick to our negative trading bias.

We suggest traders remain in the short positions initiated at the closing level of 18 Aug, or 34,887 pts. To manage the trading risks, the stop-loss threshold is pegged at 35,286 pts, ie 18 Aug’s high.

The immediate support level is marked at 34,602 pts – 3 Aug’s low – with the next support at 33,623 pts, or 19 Jul’s low. The resistance levels are eyed at 35,082 pts – 2 Aug’s high – and 35,286 pts, ie 18 Aug’s high

Source: RHB Securities Research - 23 Aug 2021