WTI Crude: Taking Profits Below the 50-Day SMA Line

rhboskres

Publish date: Wed, 01 Sep 2021, 04:53 PM

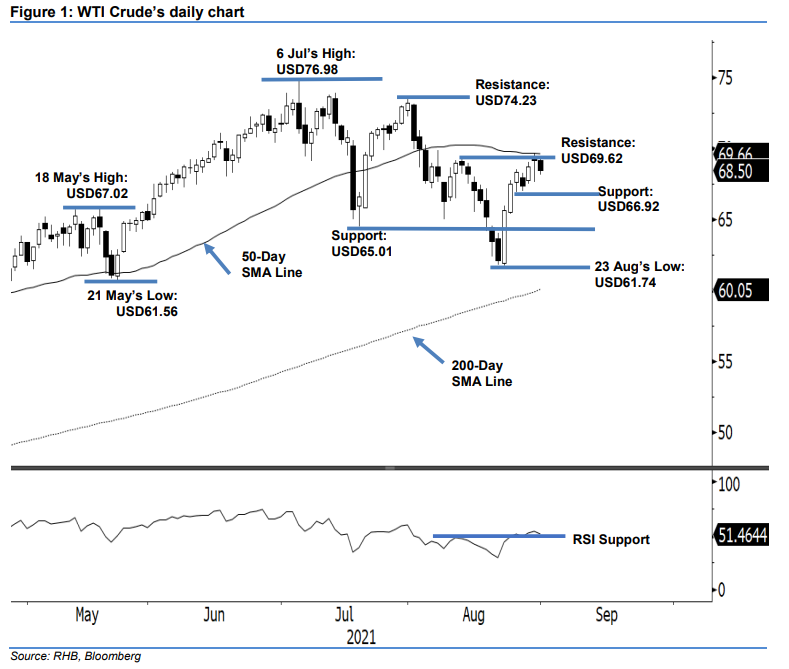

Maintain long positions. The WTI Crude attempted to cross the immediate resistance yesterday, before retracing lower by USD0.71 to close at USD68.50 – it was resisted by the 50 day SMA line. The black gold started with a neutral tone at USD69.18, then whipsawed throughout the session. The commodity first tested its day peak at USD69.34 and then the day bottom at USD68.16 before bouncing off mildly at the close. The black body candlestick suggests the bulls are taking a breather after the recent rally from August’s low. As mentioned in our previous note, if the profit taking extends, expect USD66.92 to offer itself as immediate support. Meanwile, the RSI rounding down echoes that a mild correction is immenient. As long as the WTI Crude stays above USD66.92, we believe the bullish momentum will prevail in the medium term after mild consolidations. Hence, we stick with our positive trading bias.

Traders should stay with the long positions initiated at the closing level of 24 Aug, or USD67.54. To mitigate risks, the stop-loss threshold is pegged at USD66.92, or 25 Aug’s low.

The immediate support level is fixed at USD66.92, ie 25 Aug’s low, and followed by USD65.01 – 20 Jul’s low. The resistance levels are maintained at USD69.62 – 12 Aug’s high – and USD74.23, or 30 Jul’s high.

Source: RHB Securities Research - 1 Sept 2021