E-Mini Dow: Hesitating to Breach the Immediate Resistance

rhboskres

Publish date: Thu, 02 Sep 2021, 05:27 PM

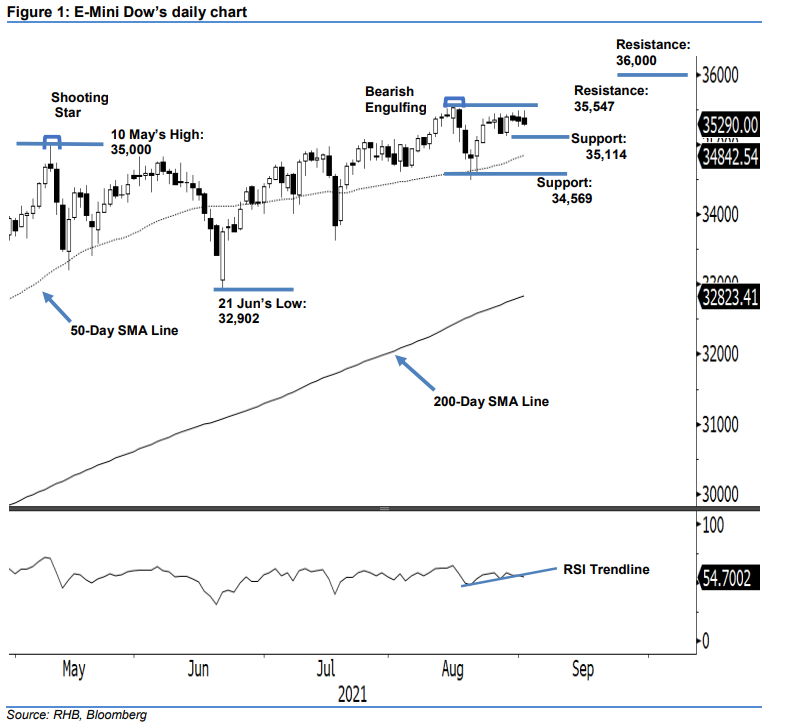

Maintain long positions. The E-Mini Dow re-attempted to test its immediate resistance yesterday, but – again – was dragged by the selling pressure during the intraday session. It fell 50 pts to settle at 35,290 pts. The index started stronger at 35,382 pts, followed by positive momentum testing the 35,494-pt day high before the end of the Asian trading session. The momentum then faltered, which saw it falling towards the end of the US trading session to hit the day bottom at 35,269 pts. The recent two consecutive sessions of black body candlesticks with upper shadows signal that further profit-taking – continuing towards the 35,114-pt immediate support – is getting more obvious. This is in tandem with the RSI pointing downwards, which increases the odds of the negative momentum gathering pace. However, since the immediate support remains intact, and “higher low” bullish pattern remains sighted, we believe the medium-term upward movement is still in play. Hence, we maintain our bullish trading bias.

We recommend traders stick to the long positions initiated at the closing level of 24 Aug, or 35,314 pts. For risk management, the initial stop-loss threshold is marked below 35,114 pts, which was the immediate support.

The immediate support is fixed at 35,114 pts, ie 27 Aug’s low, then followed by 34,569 pts – 20 Aug’s low. The nearest resistance is set at 35,547 pts – 16 Aug’s high – and followed by the 36,000-pt uncharted territory.

Source: RHB Securities Research - 2 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024