Hang Seng Index Futures: Breaching Above the 20-Day SMA Line

rhboskres

Publish date: Thu, 02 Sep 2021, 05:34 PM

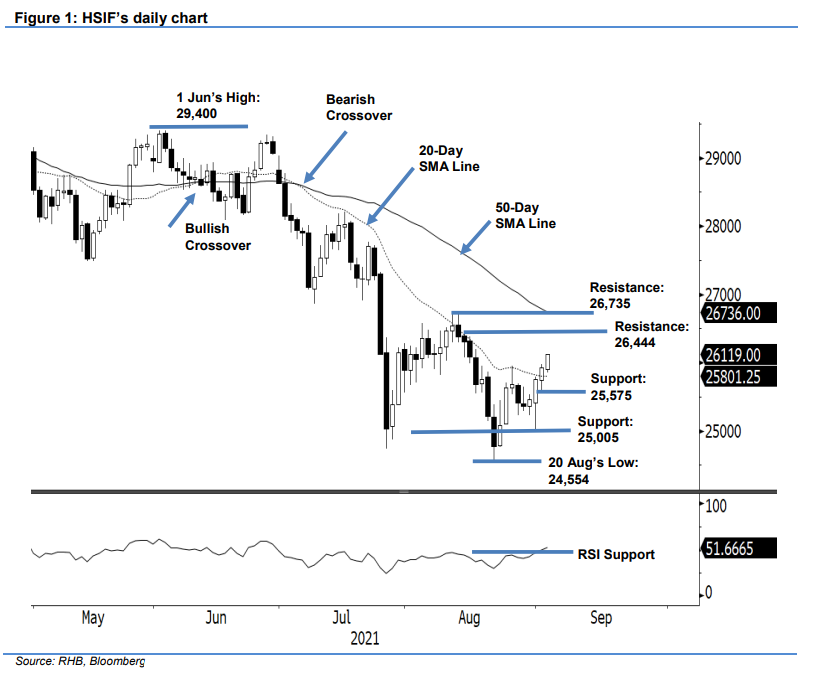

Maintain long positions. The HSIF has extended its bullish momentum, rising 172 pts to settle the day session at 25,926 pts. On Wednesday, it initially started off at 25,688 pts. After forming its day low at 25,575 pts, strong momentum lifted the index higher – it breached the 20-day SMA line to reach the 25,976-pt day high before the close. The positive momentum accelerated during the evening session, as the HSIF advanced 193 pts – it last traded at 26,119 pts. As mentioned in our previous note, breaching the 20-day SMA line will see the bullish momentum gaining pace. The bulls may eye testing the next resistance pegged at 26,444 pts, which is followed by August’s 26,735-pt high. In the event the bears take profits, we expect the 20-day SMA line to provide strong support. With the bullish momentum strengthening, we keep to our positive trading bias.

We recommend traders stick with the long positions initiated at the closing level of 24 Aug’s day session, ie 25,638 pts. To control the downside risks, the stop-loss threshold is revised higher to 25,366 pts.

The immediate support is revised to 25,575 pts – 1 Sep’s low – and is followed by 25,005 pts, ie 31 Aug’s low. The nearest resistance is eyed at 26,444 pts – 13 Aug’s high – and followed by 26,735 pts, ie 12 Aug’s high.

Source: RHB Securities Research - 2 Sept 2021