E-Mini Dow: Remaining Sideways With a Positive Tone

rhboskres

Publish date: Fri, 03 Sep 2021, 04:24 PM

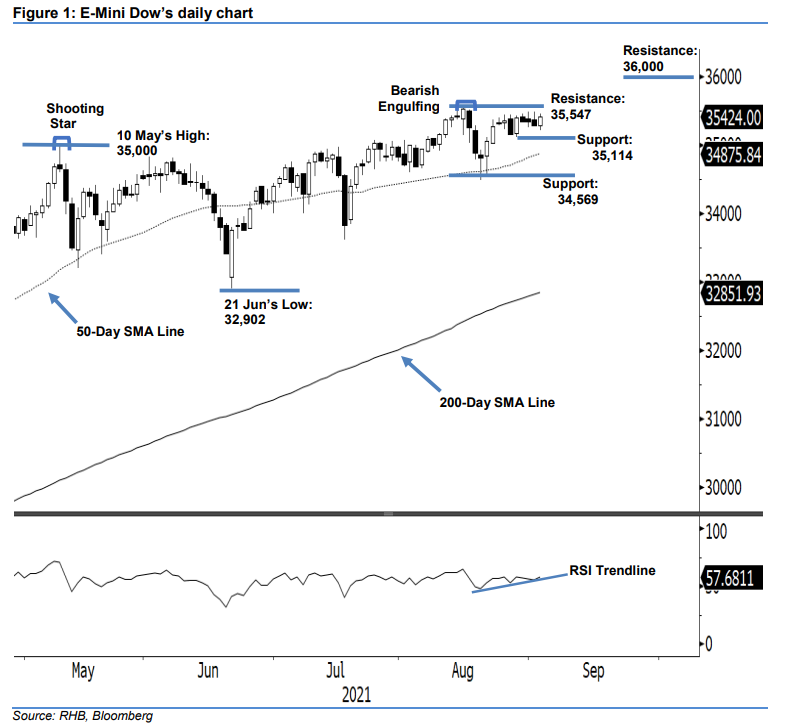

Maintain long positions. After drifting sideways recently, the E-Mini Dow bounced off higher yesterday to close 134 pts stronger at 35,424 pts – still within the recent horizontal range. The index began with a neutral tone at 35,295 pts, then drifted lower towards the 35,219-pt intraday low. Buying momentum gradually appeared to propel it north throughout the remaining trading sessions – the E-Mini Dow hit the 35,463-pt day high before a pullback towards the close. The latest white body candlestick that formed above the immediate support has drawn a “higher low” bullish structure within the tight sideways movement – increasing the odds of a medium-term upward movement. The swift change of the RSI strength from below to above 55% yesterday is a positive signal for the index to move higher in the coming sessions. Hence, we retain our bullish trading bias until the momentum reverses.

We suggest traders maintain the long positions initiated at 35,314 pts, ie the closing level of 24 Aug. For risk management, the initial stop-loss level is pegged below 35,114 pts, or the immediate support.

The nearest support is unchanged at 35,114 pts, or 27 Aug’s low, followed by 34,569 pts, ie 20 Aug’s low. The immediate resistance is marked at 35,547 pts – 16 Aug’s high – and followed by the 36,000-pt uncharted territory.

Source: RHB Securities Research - 3 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024