Hang Seng Index Futures: Struggling Near the 26,000-Pt Level

rhboskres

Publish date: Mon, 06 Sep 2021, 10:32 AM

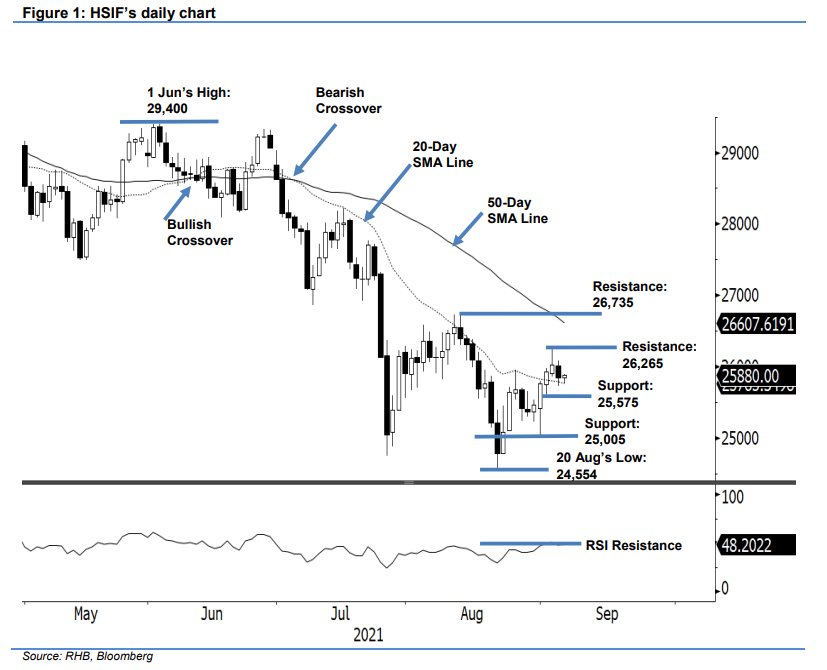

Maintain long positions. The HSIF saw mild profit-taking last Friday, retracing 179 pts to settle at 25,844 pts. The index started off Friday’s session at 25,890 pts. It whipsawed between 25,984 pts and 25,722 pts before closing weaker at 25,844 pts. After some choppy movements during the eveing session, it gained 36 pts and last traded at 25,880 pts. Despite falling below the 26,000-pt level, the HSIF managed to withstand above the 20-day SMA line. Staying above the moving average will see it continuing to print a “higher low” bullish technical setup. As long as the index continues to extend its recent “higher highs with higher lows” price pattern, we think the counter-trend movement that started from 24,554 pts stays in play. At this stage, we stick to our positive trading bias until the stop loss is breached.

We recommend traders hold on to the long positions initiated at 25,638 pts, ie the closing level of 24 Aug’s day session. To mitigate trading risks, the stop-loss threshold is placed at 25,366 pts.

The immediate support is fixed at 25,575 pts – 1 Sep’s low – and followed by 25,005 pts, ie 31 Aug’s low. The nearest resistance is sighted at 26,265 pts – 2 Sep’s high – and followed by 26,735 pts, or 12 Aug’s high.

Source: RHB Securities Research - 6 Sept 2021