WTI Crude: Bulls Take a Breather Below the 50-Day SMA Line

rhboskres

Publish date: Tue, 07 Sep 2021, 10:30 AM

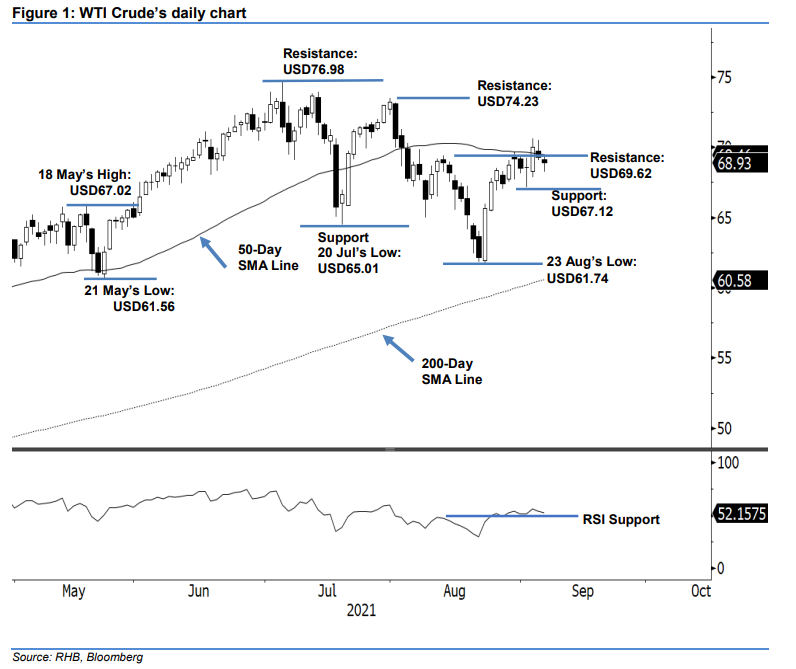

Maintain long positions. Due to the holiday being observed in the US, the WTI Crude’s trading interest softened with mild negative momentum. At the time of writing, it corrected USD0.36 and last traded at USD68.93 with a lower shadow sighted. The black gold started weaker at USD69.11 and fell to the USD68.25 day low before bouncing towards the USD69.48 day high. The current candlestick remains in progress until the next settlement. The latest price action is in line with our earlier expectation, ie a pullback towards the USD67.12 immediate support while retaining a positive medium-term outlook. With the RSI strength still above the 50% level, we expect the medium-term momentum to pick up pace again once the correction is over. As such, we maintain our positive trading bias.

Traders should stick to the long positions initiated at the closing level of 24 Aug at USD67.54. To mitigate risks, the stop-loss level is set at USD67.12, ie 1 Sep’s low.

The nearest support level is eyed at USD67.12 – 1 Sep’s low – and followed by USD65.01, ie 20 Jul’s low. The immediate resistance level is marked at USD69.62, or 12 Aug’s high. This is followed by USD74.23, which was 30 Jul’s high.

Source: RHB Securities Research - 7 Sept 2021