COMEX Gold: Falling Back to Test the 20-Day SMA Line

rhboskres

Publish date: Wed, 08 Sep 2021, 07:02 PM

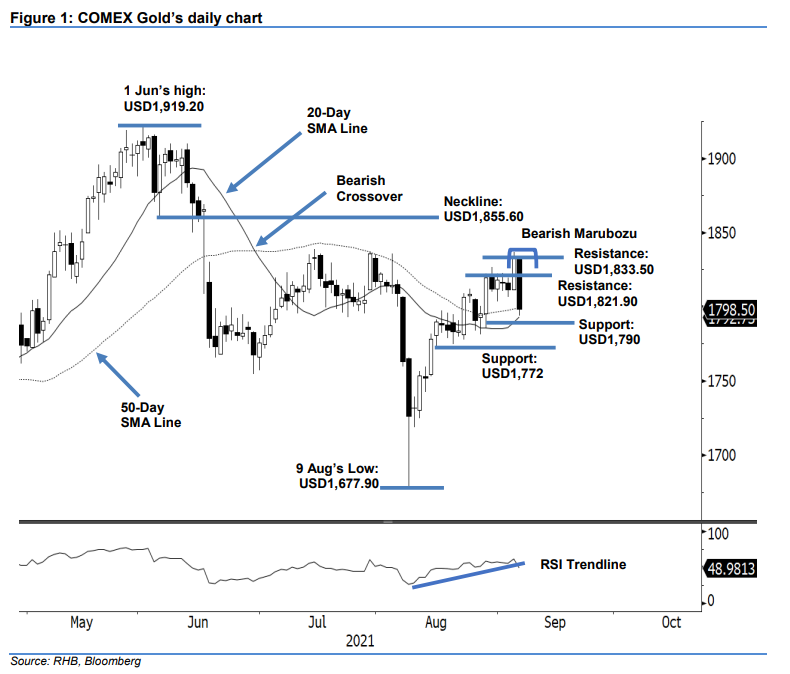

Maintain long positions. The COMEX Gold saw the worst session since 9 Aug, plunging USD35.20 to settle at USD1,798.50. After coming back from the US Labour Day holiday, the bulls were nervous – this saw the commodity slipping to its USD1,793.70 intraday low before the close. The latest session printed a Bearish Marubozu candlestick that has negated the gains made since 26 Aug. If the bearish candlestick sees an extension in the immediate session, or breaches below the 20-day SMA line, it will form a fresh “lower low” bearish pattern – hence putting an end to the recent upward movements. At this stage, we are keeping to our positive trading bias until the trailing-stop threshold is triggered.

Traders should retain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To mitigate the trading risks, the trailing stop is fixed at USD1,790, ie just beneath the 20-day SMA line.

The nearest support is revised to the USD1,790 whole number, followed by USD1,772, ie 16 Aug’s low. The nearest resistance is seen at USD1,821.90 – 31 Aug’s high – and followed by USD1,833.50, or 7 Sep’s high.

Source: RHB Securities Research - 8 Sept 2021