WTI Crude: Retracing Below the 50-Day SMA Line

rhboskres

Publish date: Wed, 08 Sep 2021, 07:10 PM

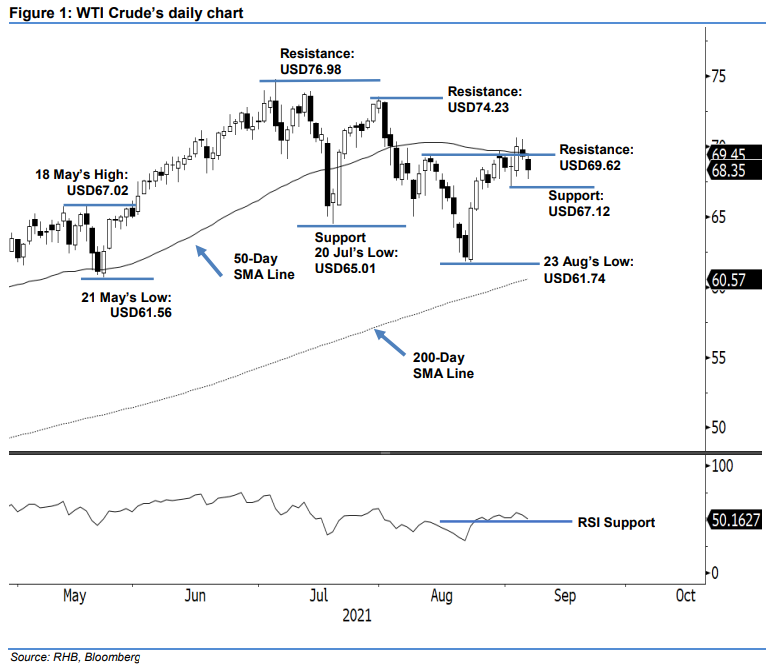

Maintain long positions. In sequence with Monday’s session, the WTI Crude settled at USD68.35 yesterday, which saw it decline USD0.94 vs Friday’s close. The black gold, which began weaker on Monday at USD69.11 and bounced off towards the USD69.48 day high, saw a strong decline towards the USD67.64 day low during the European trading session yesterday. It then bounced off mildly to partially pare the intraday losses before the close. The latest black body candlestick with long lower shadow – as the WTI Crude attempted to hit the immediate support – is consistent with our earlier expectation of a pull-back occuring towards the USD67.12 immediate support while maintaining the bullish medium-term prospects. Supported by the RSI lowering near the 50% level, we expect further profit-taking activities above the immediate support to be observed before the bullish momentum resumes for a medium-term bullish bias. Unless the stop-loss level is triggered, we stick to our positive trading bias.

Traders should maintain the long positions initiated at the closing mark of 24 Aug at USD67.54. To mitigate risks, the stop-loss threshold is pegged at USD67.12, ie 1 Sep’s low.

The support levels remain unchanged at USD67.12 – 1 Sep’s low – and USD65.01, or 20 Jul’s low. The immediate resistance level is fixed at USD69.62, ie 12 Aug’s high. This is followed by USD74.23 – 30 Jul’s high.

Source: RHB Securities Research - 8 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024