Hang Seng Index Futures- Consolidating Before the 50-day SMA Line

rhboskres

Publish date: Thu, 09 Sep 2021, 05:34 PM

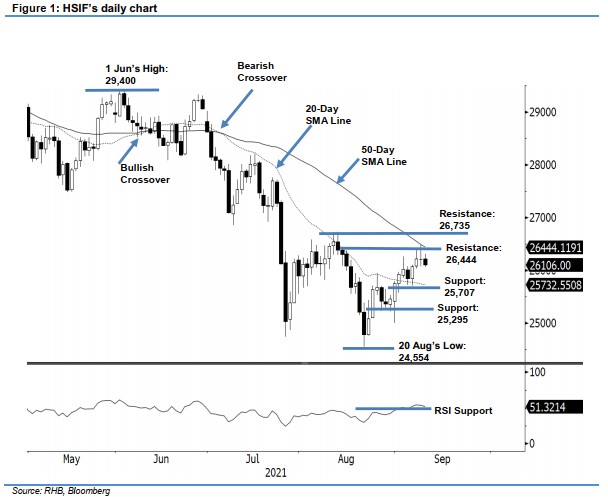

Maintain long positions. The HSIF failed to stage a follow-through price action yesterday, dipping 12 pts to settle the day session at 26,213 pts. The index initially opened stronger at 26,134 pts and rose to test the intraday high of 26,478 pts. The brief momentum faltered not long after this opening, which saw the HSIF progress lower, retracing to reach the 26,072-pt day low before the close. Tracking its US peers, sentiment turned cautious, which saw the index correcting 107 pts – it last traded at 26,106 pts. Although it has yet to extend its upward movement, the HSIF managed to sustain above the 20-day SMA line and retained the “higher low” bullish structure. Expect a mild consolidation in the immediate session before momentum picks up pace again. As of now, we make no changes to our positive trading bias.

We recommend traders retain the long positions initiated at 25,638 pts, ie the closing level of 24 Aug’s day session. To manage the trading risks, the trailing-stop level is placed at 25,700 pts.

The immediate support is marked at 25,707 pts – 6 Sep’s low – and followed by 25,295 pts, ie 27 Aug’s low. The nearest resistance is seen at 26,444 pts – 13 Aug’s high – and followed by 26,735 pts, or 12 Aug’s high.

Source: RHB Securities Research - 9 Sept 2021