FKLI: Overhead Resistance Still Intact

rhboskres

Publish date: Thu, 09 Sep 2021, 04:53 PM

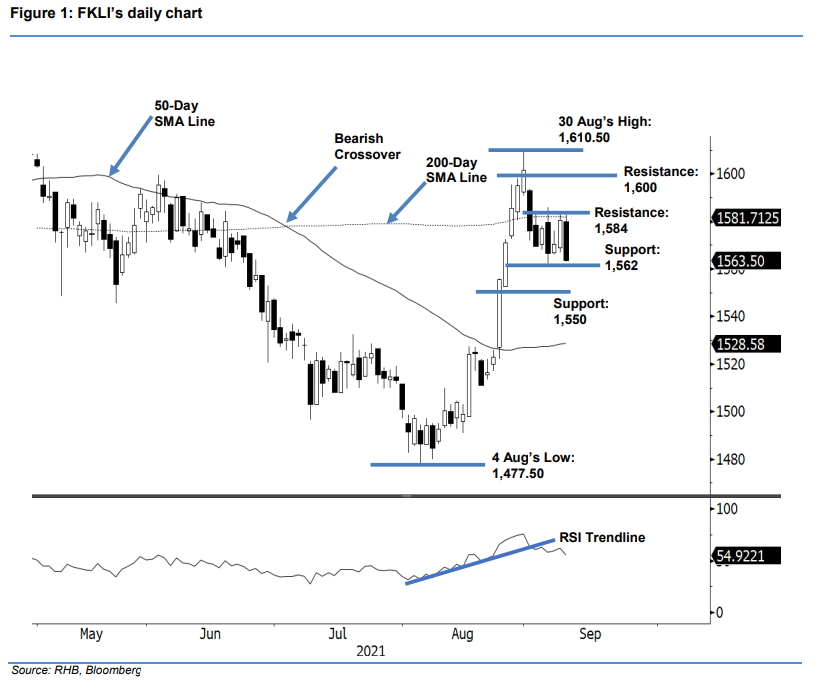

Maintain short positions. The FKLI saw the brief bullish momentum erase yesterday as it declined 17 pts to settle at 1,563.50 pts. Initially, the index began flat at 1,569 pts and rose to test the intraday high at 1,583 pts. Sentiment gradually turned negative as the session progressed, with the index correcting sharply towards the 1,563-pt day low before the close. Looking back the last four sessions, observe that the two bullish sessions were sandwiched between two bearish sessions. This formed a sideways range between 1,562 pts and 1,584 pts – breaking out of either boundary will see a new trend forming. As the index has been moving lower since 1,610.50 pts, forming a series of “lower highs”, coupled with the 200-day SMA line acting as an overhead resistance, the risk is tilted towards the downside now. Unless the momentum reverses and breaks above the stop-loss, we keep to our negative trading bias.

We recommend traders maintain their short positions initiated at 1,569.50 pts, or the close of 2 Sep. To control the downside risks, the stop-loss threshold is placed at 1,584 pts.

The immediate support is fixed at 1,562 pts, followed by the second support at 1,550 pts. Towards the upside, the nearest resistance seen at 1,584 pts, the high of 8 Sep, followed by the 1,600-pt psychological level.

Source: RHB Securities Research - 9 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024