FCPO: Pullback To Test The Immediate Support

rhboskres

Publish date: Thu, 09 Sep 2021, 04:54 PM

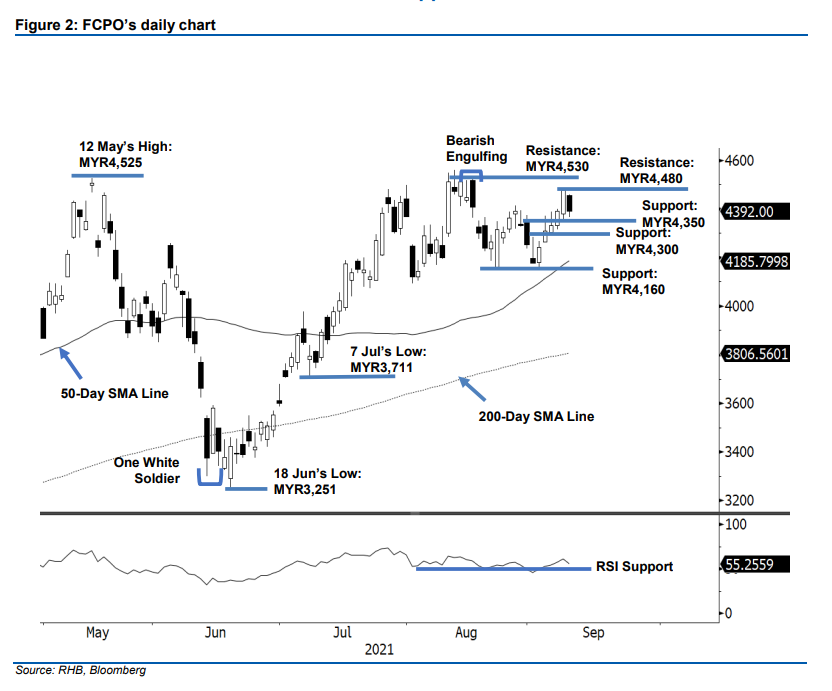

Maintain long positions. The FCPO saw selling pressure re-emerge yesterday as it declined MYR86 to settle at MYR4,392. The sentiment turned cautious during the opening as the commodity gapped down to open at MYR4,455. Following that, the bears took charge and the FCPO fell to the MYR4,367 day low before the close. As mentioned in the previous note, we are anticipating volatility to pick up in the coming sessions. If the selling pressure intensifies and breaks below the MYR4,300 level, this may affirm that the previous breakout of MYR4,350 was a false breakout, and result in a downside correction. At this time, we believe that MYR4,350 is providing an immediate support. As such, we maintain our positive trading bias until the stop-loss is breached.

Traders should stay in long positions initiated at MYR4,390, or the closing level of 7 Sep. To control the downside risks, the stop-loss threshold is fixed at MYR4,300.

The first support is marked at MYR4,350, or the opening of 30 Aug, followed by the MYR4,300 round number. The nearest resistance is eyed at MYR4,480 – the high of 8 Sep – followed by MYR4,530, or the high of 17 Aug.

Source: RHB Securities Research - 9 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024