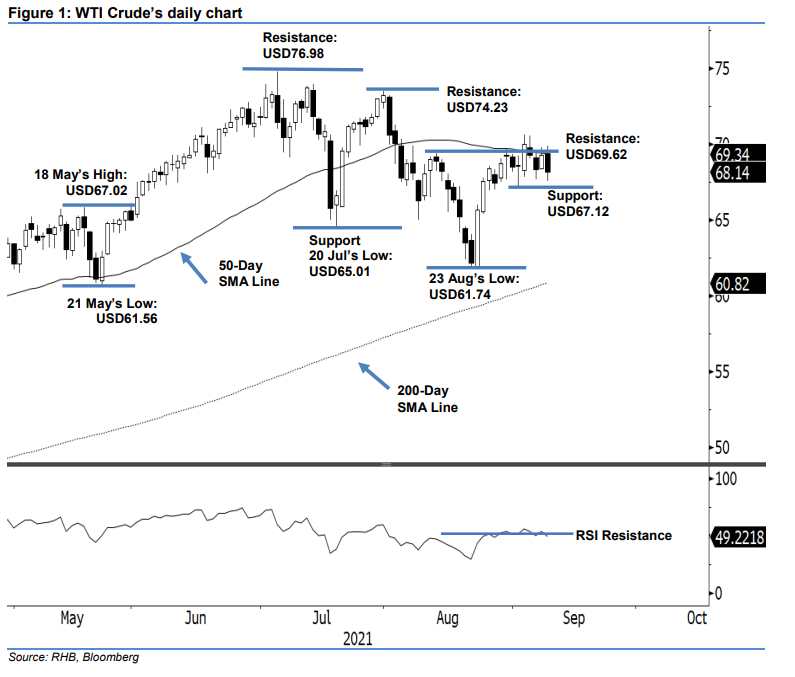

WTI Crude: Strong Selling Pressure Below the 50-Day SMA Line

rhboskres

Publish date: Fri, 10 Sep 2021, 04:56 PM

Keep long positions. The WTI Crude pared the intraday gains yesterday, which saw it falling by USD1.16 to settle at USD68.14 – further away from the immediate resistance and 50-day SMA line. It began at USD69.36 and then whipsawed in a sideways direction before hitting the day’s peak at USD69.89. Strong selling pressure then kicked in, which saw a volatile trading session towards the US trading session before touching the day low at USD67.56 – it then mildly retraced before the close. The long black body candlestick below the immediate resistance suggests that selling pressure is imminent in the short term towards the USD67.12 immediate support. Supported by the RSI reversing below the 50% level, we expect the bearish momentum to follow through in the coming sessions. Since the WTI Crude has yet to breach the stop loss – also its immediate support – we maintain our bullish trading bias.

Traders should stick to the long positions initiated at USD67.54, ie the closing level of 24 Aug. To mitigate risks, the stop-loss mark is set at USD67.12 or 1 Sep’s low.

The nearest support level is eyed at USD67.12 – 1 Sep’s low – and followed by USD65.01, ie 20 Jul’s low. The immediate resistance level is marked at USD69.62, which was 12 Aug’s high, and followed by USD74.23, or 30 Jul’s high.

Source: RHB Securities Research - 10 Sept 2021