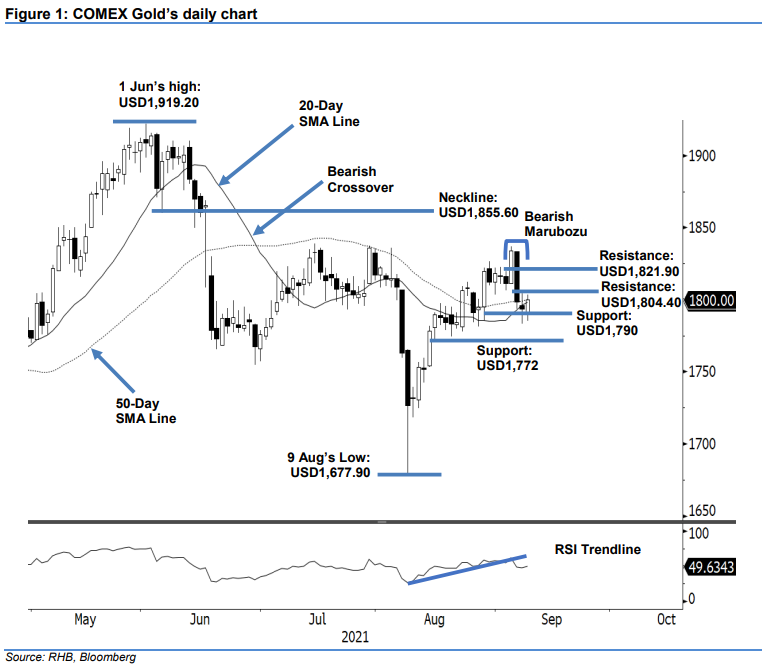

COMEX Gold: Climbing Above the 20-Day SMA Line Again

rhboskres

Publish date: Fri, 10 Sep 2021, 04:56 PM

Maintain long positions. The COMEX Gold climbed above the 20-day SMA line again, rising USD6.50 to settle at USD1,800. It had a shaky start, opening weaker at USD1,790.90. It oscillated between USD1,785.10 and USD1,803.40 before the close. While it managed to climb above the short-term moving average line, it fell short below the 50-day SMA line. We expect the commodity to continue to spiral along the two moving averages in coming sessions. A new trend will be formed if the yellow metal breaks out from either boundary of USD1,804.40 or USD1,790. Since the Bearish Marubozu pattern appeared on 7 Sept, the commodity has yet to form a fresh “higher high”, and therefore, downside risks persist. We keep our positive trading bias until the trailing-stop is breached.

Traders should keep the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For risk management, the stop-loss is set at USD1,790.

The immediate support remains at USD1,790, followed by USD1,772 – 16 Aug’s low. The first resistance is kept at USD1,804.40 – 8 Sep’s high – followed by USD1,821.90, or 31 Aug’s high.

Source: RHB Securities Research - 10 Sept 2021

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)