Hang Seng Index Futures: Strong Rebound From the 20-Day SMA Line

rhboskres

Publish date: Mon, 13 Sep 2021, 08:43 AM

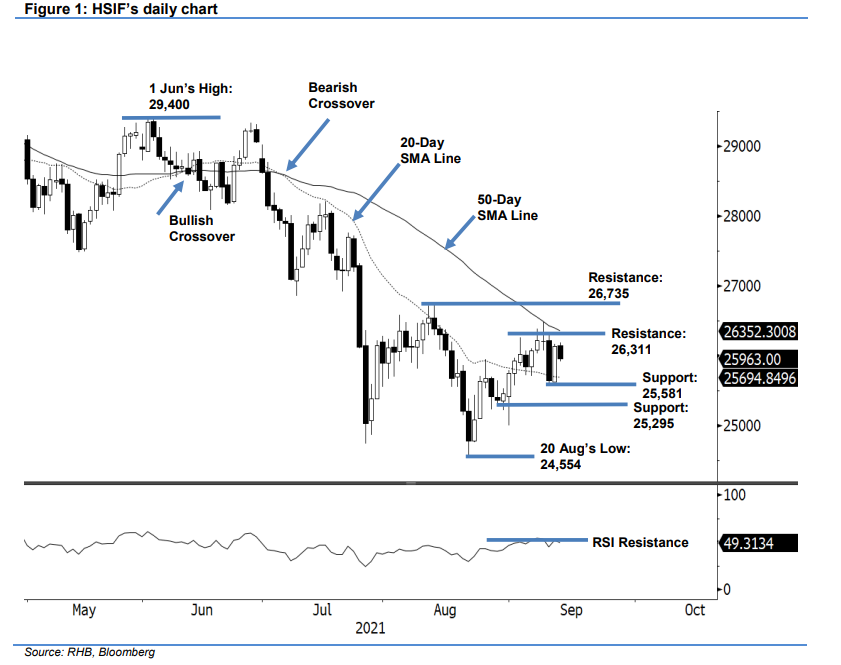

Maintain short positions. After Thursday’s strong selling, the HSIF saw a significant rebound from the 20-day SMA line on Friday, jumping 495 pts to settle the day session at 26,141 pts. On Friday, after opening at 25,814 pts, strong buying momentum lifted the index to the 26,174-pt day high. It moved sideways near this level for the rest of the session. During the evening session, it tracked its US peers’ weakness, with a 178-pt pullback, and was last traded at 25,963 pts. Overall, the latest session recouped the bulk of Thursday’s losses. If bullish momentum follows though, and the 26,311-pt immediate resistance is breached, the uptrend may be revived. Meanwhile, if the index drifts lower for consolidation, the 20-day SMA line or 25,581-pt level will provide downside support. At this stage, we stick to our negative trading bias until the stop-loss is breached.

We recommend traders maintain the short positions initiated at 25,646 pts or the close of 9 Sep’s day session. To manage trading risks, the initial stop-loss is placed at 26,330 pts.

The nearest support is revised to 25,581 pts or the low of 9 Sep, followed by the lower support level at 25,295 pts (27 Aug’s low). The immediate resistance is seen at 26,311 pts or 9 Sep’s high, followed by 26,735 pts, or 12 Aug’s high.

Source: RHB Securities Research - 13 Sept 2021