WTI Crude: Bulls Re-Emerge Above the 50-Day SMA Line

rhboskres

Publish date: Mon, 13 Sep 2021, 08:43 AM

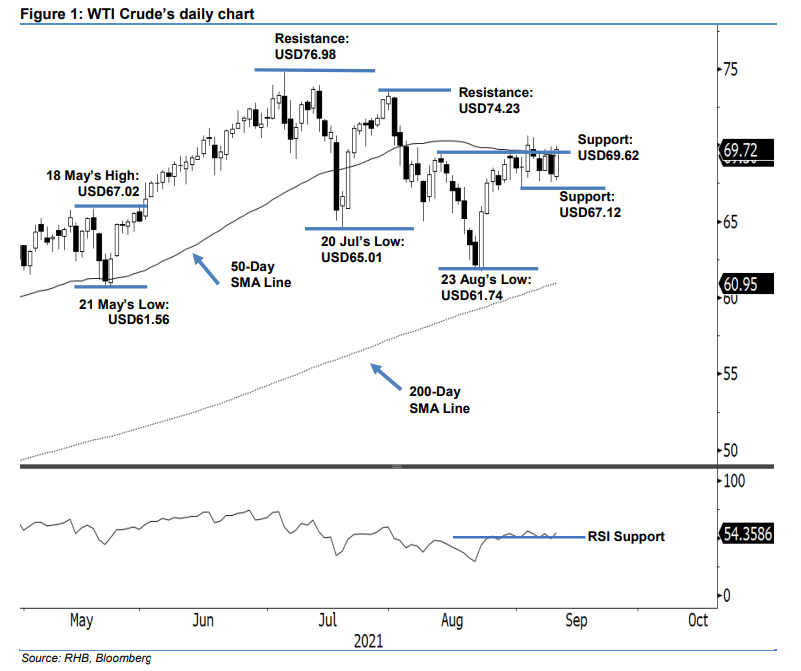

Keep long positions. The WTI Crude reclaimed above the 50-day SMA line last Friday, which saw it rising USD1.58 to settle at USD69.72 – breaching above the immediate resistance level. The commodity started at USD69.97 and touched the day low at USD67.68 before bouncing off northwards until the end of the trading session – it hit the day’s peak at USD69.96 before mildly retracing before the close. The long white candlestick above the USD69.62 immediate resistance suggests that buying pressure has re-emerged above the average line – negating the recent selling pressure. Coupled with the RSI pointing higher near the 55% level, we expect the bullish momentum to follow through in the coming sessions. As such, we stick to our bullish trading bias until the momentum reverses.

Traders should maintain the long positions initiated at USD67.54, or the closing level of 24 Aug. To mitigate risks, the stop-loss threshold is pegged at USD67.12, ie 1 Sep’s low.

The immediate support level is revised higher at USD69.62, which was 12 Aug’s high, and then followed by USD67.12, or 1 Sep’s low. The resistance levels are set at USD74.23 – 30 Jul’s high – and USD76.98, ie 6 Jul’s high.

Source: RHB Securities Research - 13 Sept 2021