FCPO: Negative Momentum Accelerating

rhboskres

Publish date: Mon, 13 Sep 2021, 08:51 AM

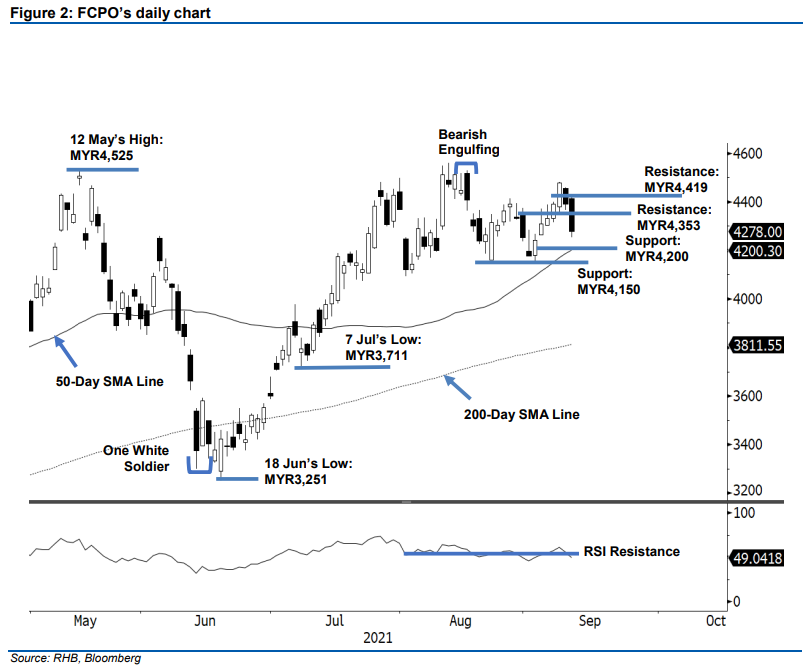

Stop-loss triggered; initiate short positions. The FCPO saw selling pressure accelerate last Friday, plunging MYR114 to settle at MYR4,278. The commodity initially opened stronger on Friday’s session, gapping up to start at MYR4,415 and touching the MYR4,419 day high. However, the strong opening did not spur a rally, instead, selling pressure intensified and brought the commodity lower towards the MYR4,253 day low before closing at MYR4,278. The latest session indicates that the bulls have failed to retain the MYR4,300 threshold. As the RSI is pointing downwards, the negative momentum is picking up pace and may potentially to see a follow through price action to test the 200-day SMA line or the MYR4,200 immediate support. Breaching the moving average may see the FCPO drift lower to test September’s low at MYR4,150. As the negative momentum is growing, with the stop-loss breached, we shift to a negative trading bias.

We closed out the long positions initiated at MYR4,390, or the closing level of 7 Sep after triggering the stop-loss at MYR4,300. Conversely, initiate short positions at the closing of 10 Sep, ie MYR4,278. To manage the trading risks, the initial stop-loss is placed at MYR4,419, or the high of 10 Sep.

The first support is revised to the MYR4,200 round figure, followed by the MYR4,150 the low of 2 Sep. The nearest resistance is revised to MYR4,353 – the low of 8 Sep – followed by MYR4,419, or the high of 10 Sep.

Source: RHB Securities Research - 13 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024