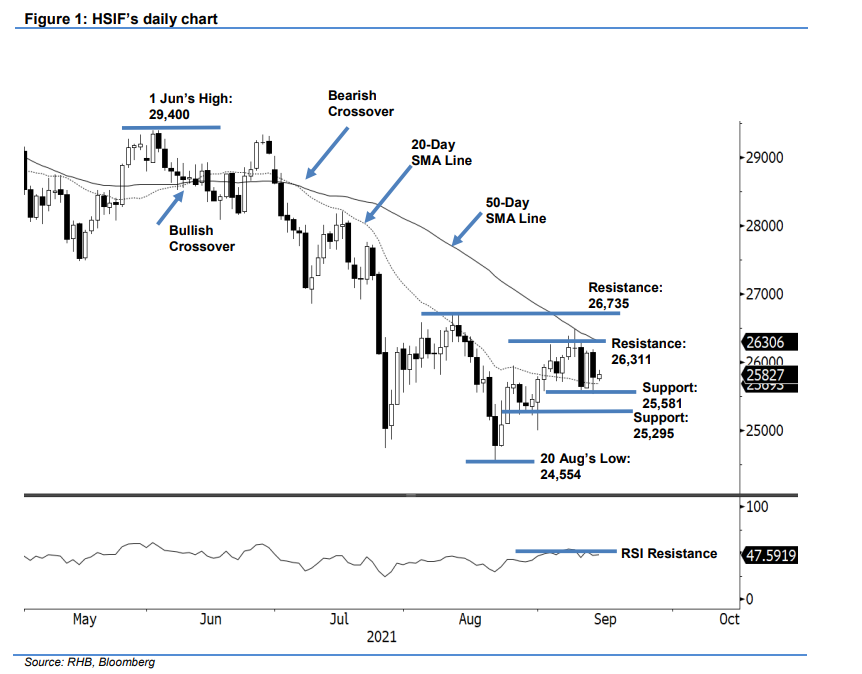

Hang Seng Index Futures: Supported by the 20-Day SMA Line

rhboskres

Publish date: Tue, 14 Sep 2021, 08:40 AM

Maintain short positions. Yesterday, the HSIF pared the bulk of Friday’s gains, declining 356 pts to settle the day session at 25,785 pts. It opened weaker at 25,922 pts. Sentiment turned negative, with the index falling lower to the 25,532-pt day low, before a mild rebound to close at 25,785 pts. It recouped 42 pts and was last traded at 25,827 pts during the evening session. Strong buying interest was seen near the 20-day SMA line. With the RSI dipping below the 50% threshold – indicating weak momentum ahead – the index may move sideways, between 25,581 pts and 26,311 pts, until either side of the boundary is breached. For now, we keep our negative trading bias.

Traders should hold on to the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To mitigate trading risks, the initial stop-loss is placed at 26,330 pts.

The nearest support is marked at 25,581 pts or the low of 9 Sep, followed by the second support at 25,295 pts (27 Aug’s low). The immediate resistance is seen at 26,311 pts or 9 Sep’s high, followed by 26,735 pts, or 12 Aug’s high.

Source: RHB Securities Research - 14 Sept 2021