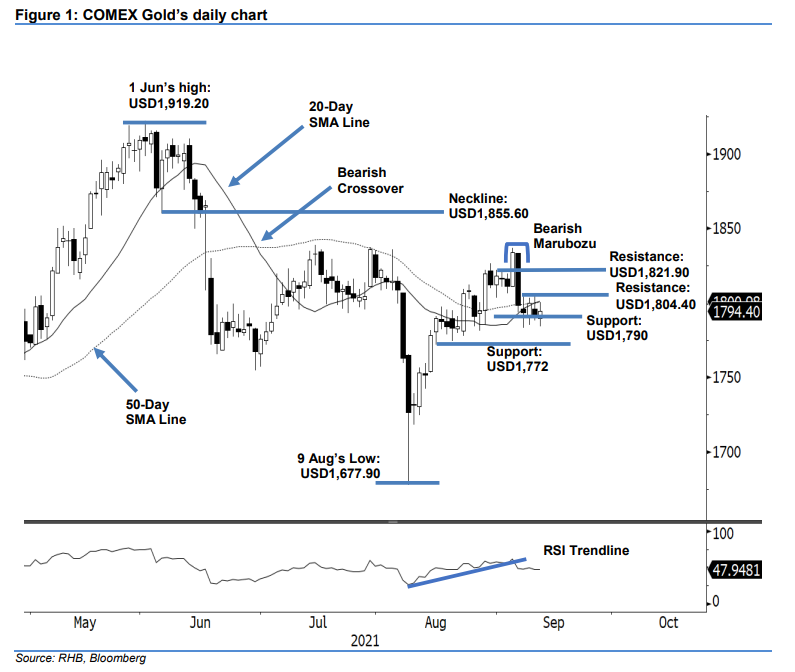

COMEX Gold: Hovering Below the 20-Day SMA Line

rhboskres

Publish date: Tue, 14 Sep 2021, 08:40 AM

Maintain long positions. After falling below the 20-day SMA line, the COMEX Gold moved sideways, adding USD2.30 to settle at USD1,794.40. It started off Monday’s session at MYR1,789.80, and dipped to the session’s low of USD1,784.40. Mild buying interest was seen during the US trading session, lifting it to test the session’s high of USD1,800.20 before retracing to close at USD1,794.40. The 20-day SMA line has crossed above the 50- day SMA line. Meanwhile, the bulls attempted to reclaim their position above the two moving averages. However, the brief momentum failed to follow through. As the RSI has fallen below the 50% threshold, the commodity may consolidate near its immediate support. If the immediate support gives way, a fresh “lower low” bearish pattern will be formed. We stick to our positive trading bias until the trailing-stop is breached.

We recommend traders maintain the long positions initiated at USD1,778.20, or the closing level of 13 Aug. To manage downside risks, the trailing-stop is placed at USD1,790.

The immediate support stays at USD1,790, followed by USD1,772 – 16 Aug’s low. The nearest resistance is seen at USD1,804.40 – 8 Sep’s high – followed by USD1,821.90, or 31 Aug’s high.

Source: RHB Securities Research - 14 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024