FKLI: Downside Risk Remains

rhboskres

Publish date: Tue, 14 Sep 2021, 06:33 PM

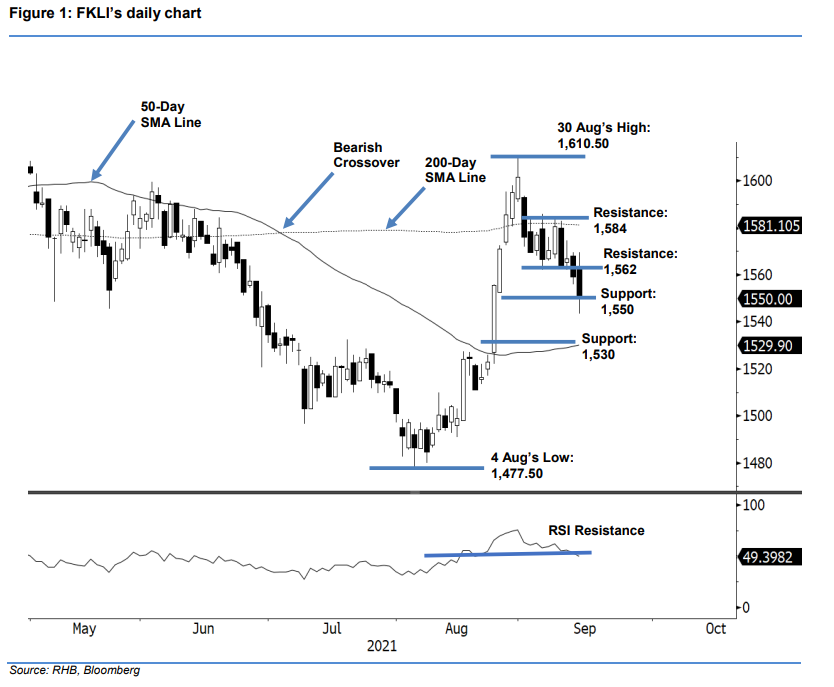

Maintain short positions. The FKLI saw selling pressure extend on Tuesday, falling 9 pts to settle at 1,550 pts – sitting on the immediate support. Yesterday, the index initially opened stronger at 1,563 pts. After it rose to test the 1,569.50-pt day high, it fell towards the 1,543.50-pt day low before the close – printing a back-to-back bearish candlestick. As mentioned in the previous note, the index has been moving downwards since a bearish breakout from the 1,562-pt level on 13 Sep. The previous support level (1,562 pts) has become a stiff resistance now, as shown in the latest session. Meanwhile, breaching the 1,550-pt immediate support would see the index retrace towards the 50-day SMA line. Since the bears are in control now, we retain our negative trading bias.

Traders should hold on to their short positions initiated at 1,569.50 pts, or the close of 2 Sep. For trading risk management, the stop-loss threshold is revised to 1,576 pts.

The immediate support is kept at 1,550 pts, followed by the next support at 1,530 pts. Towards the upside, the nearest resistance is sighted at 1,562 pts, the low of 6 Sep, and followed by 1,584 pts ie the high of 8 Sep.

Source: RHB Securities Research - 14 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024