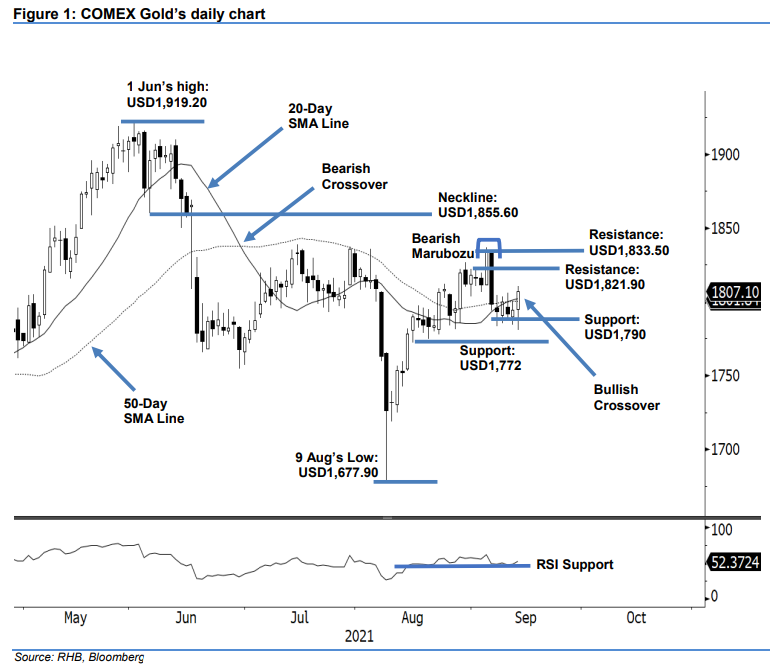

COMEX Gold: Struggling to Return Above the 20-Day SMA Line

rhboskres

Publish date: Wed, 15 Sep 2021, 06:36 PM

Maintain long positions. The COMEX Gold pared its intraday losses to close higher yesterday, settling USD12.70 higher at USD1,807.10. It began at MYR1,794.80, and gradually declined to the session’s low of USD1,780.60, before strong buying interest emerged midway through the European trading session. The yellow metal then moved up towards the session’s high of USD1,810.60, before retracing mildly towards the close. The latest bullish candlestick – which reclaimed its position above the two moving averages – solidifies the recent bullish crossover, when the 20-day SMA line crossed above the 50-day SMA line. Strong bullish momentum is expected to follow through in the coming sessions, as the RSI returned above the 50% level yesterday. Hence, we keep our positive trading bias until it reverses and breaches the trailing-stop.

We suggest traders stay in the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For risk management, the trailing-stop is fixed at USD1,790.

The immediate support remains at USD1,790, followed by USD1,772 – 16 Aug’s low. The nearest resistance is revised and pegged at USD1,821.90, or 31 Aug’s high, followed by USD1,833.50, which was 7 Sep’s high.

Source: RHB Securities Research - 15 Sept 2021