E-Mini Dow: the Bearish Momentum Continues

rhboskres

Publish date: Wed, 15 Sep 2021, 06:37 PM

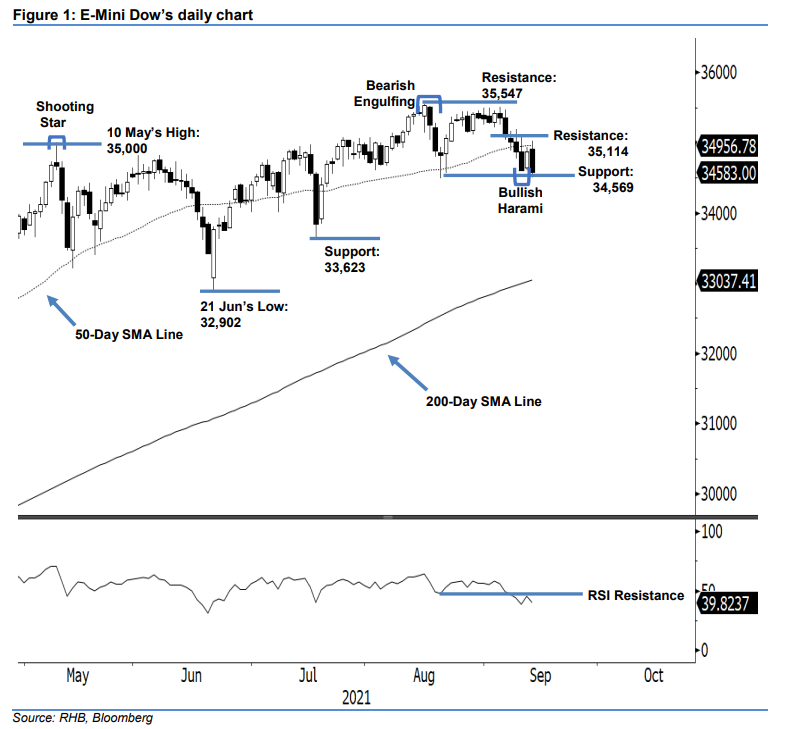

Keep short positions. The E-Mini Dow displayed a strong bearish momentum yesterday as the index closed 287 pts lower at 34,583 pts – setting off the previous session’s gains. The index began at 34,916 pts and whipsawed mildly in a downwards movement until a sudden spike in buying interest emerged before the US trading session started to hit the 35,021-pt day high. Strong selling pressure then appeared to swiftly change the direction southwards – it touched the day’s low of 34,507 pts before bouncing off mildly towards the close. The long black body candlestick has nullified the previous “bullish harami” candlestick pattern, signalling a downtrend continuation in the coming sessions – in line with our recent medium-term outlook, as the E-Mini Dow is still trading below the average line and immediate resistance level. Additionally, the RSI was inching lower below the 50% level yesterday. As such, we maintain our bearish trading bias.

We recommend traders stick to the short positions initiated at the closing level of 7 Sep, or 35,091 pts. To manage the risks, the stop-loss threshold is pegged at 35,114 pts, or the immediate resistance.

The nearest support is set at 34,569 pts – 20 Aug’s low – and then followed by 33,623 pts, ie 19 Jul’s low. The resistance thresholds are pegged at 35,114 pts – 27 Aug’s low – and 35,547 pts, or 16 Aug’s high.

Source: RHB Securities Research - 15 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024