COMEX Gold: Hovering Near September’s Low

rhboskres

Publish date: Tue, 28 Sep 2021, 09:01 AM

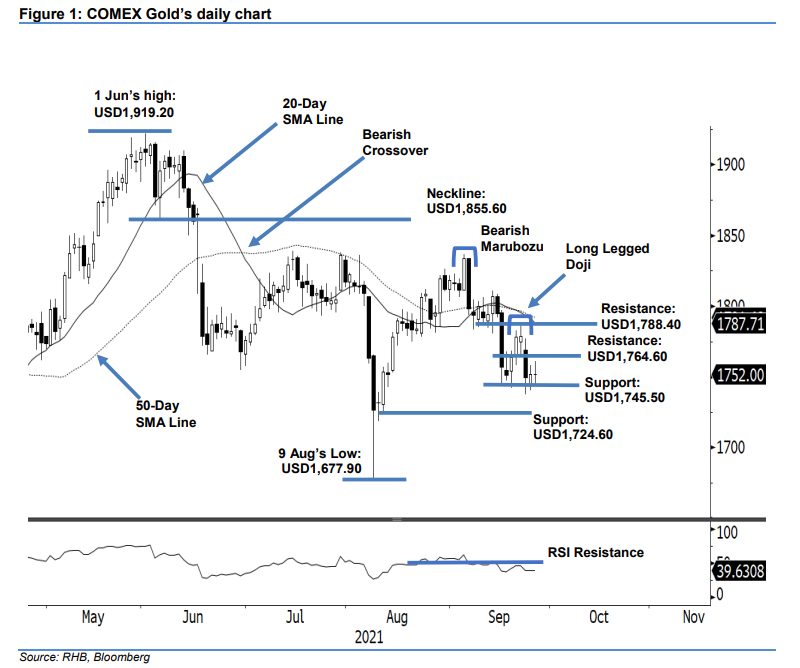

Maintain short positions. The COMEX Gold was seen consolidating sideways near the immediate support, inching USD0.30 higher to settle at USD1,752. The commodity started Monday’s session at USD1,751.80. After swinging between USD1,760.90 and USD1,744.70, it closed at USD1,752, forming a Doji candlestick. Although the latest session saw a neutral closing, the commodity managed to retain the immediate support level. As the bears are taking a breather, the COMEX Gold may move sideways in the coming sessions, ahead of the next breakout. At this stage, it has yet to form a fresh “higher high”, and the RSI is trending below the 50% threshold. Therefore, the risk of another downside correction is still valid. Hence, we stick to our negative trading bias.

We advise traders to maintain the short positions initiated at USD1,756.70, or the closing level of 16 Sep. For risk management, the stop-loss threshold is set at USD1,780.

The first support is established at USD1,745.50 – 16 Sep’s low – followed by USD1,724.60 or 11 Aug’s low. The nearest resistance is sighted at USD1,764.60 – 22 Sep’s low – followed by USD1,788.40, 22 Sep’s high.

Source: RHB Securities Research - 28 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024