Hang Seng Index Futures: Moving Sideways

rhboskres

Publish date: Wed, 29 Sep 2021, 08:33 AM

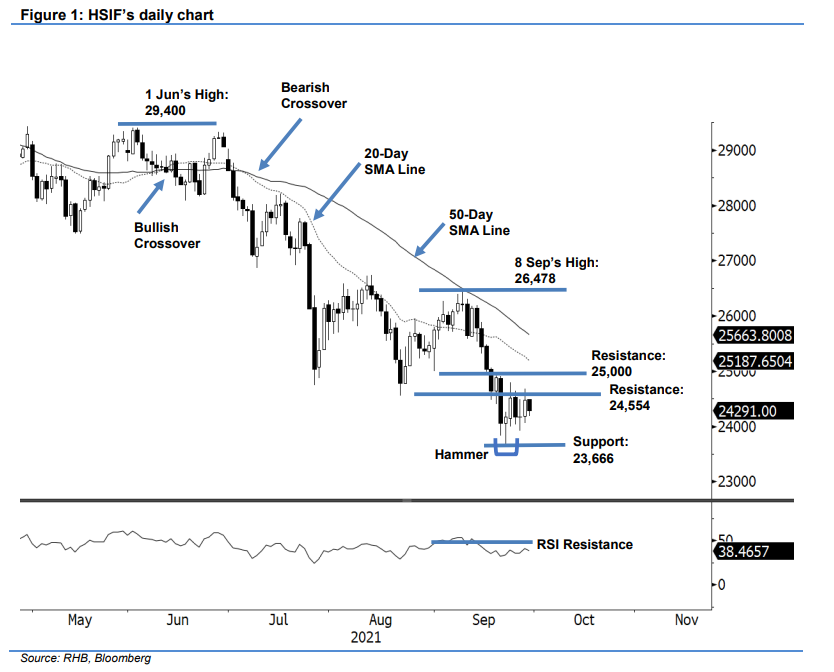

Maintain short positions. The HSIF attempted to stage a technical rebound yesterday, rising 308 pts to settle the day session at 24,476 pts. It started Tuesday’s session at 24,222 pts and climbed to the 24,680-pt day high. After hitting the intraday high, it retraced to close at 24,476 pts. The evening session was disappointing, as profit-taking erased the bulk of the gains made during the day session, with the index retreating 185 pts to close at 24,291 pts – barely above the day session’s opening level. If negative momentum extends, the index may retrace to retest the Hammer’s low of 23,666 pts. On the other hand, a breach above 24,554 pts will improve trading sentiment and carry the index higher. At this stage, it is likely that the index will keep moving sideways, as downside risks persist. As such, we hold on to our bearish trading bias until the stop-loss is breached.

Traders are advised to stick with the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To mitigate trading risks, the stop-loss is kept at 24,800 pts.

The immediate support stays at 23,666 pts or 21 Sep’s low, followed by the 23,400-pt round figure. The nearest resistance is kept at 24,554 pts – 20 Aug’s low – and the higher resistance is at the 25,000-pt psychological level.

Source: RHB Securities Research - 29 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024