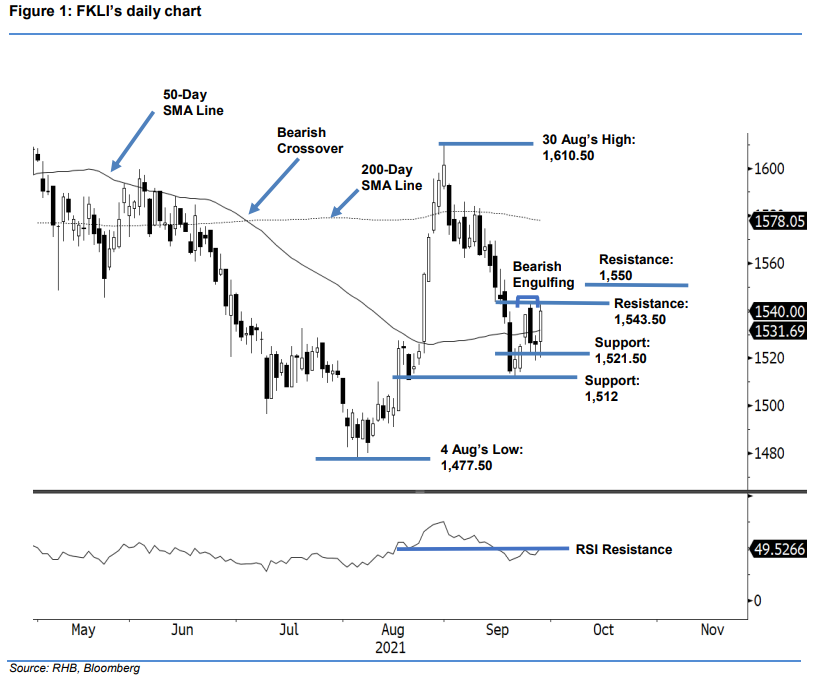

FKLI: Crossing Up The 50-Day SMA Line

rhboskres

Publish date: Wed, 29 Sep 2021, 08:36 AM

Maintain long positions. The FKLI’s bullish momentum picked up on Tuesday’s session, rebounding 14 pts to close stronger at 1,540 pts – as it managed to reclaim the 50-day SMA line. On Tuesday morning, it opened at 1,527 pts and fell rapidly to the session’s low of 1,520 pts before it bounced off and climbed towards 1,542.50 pts amid strong buying interest as it closed at 1,540 pts – printing a long white candlestick. With the latest positive price action, the bulls are back in the driver’s seat. The bullish momentum may accelerate northward to test the 1,543.50-pt immediate resistance. Breaching the immediate resistance will negate the Bearish Engulfing pattern and result in the index resuming its upward trajectory. Meanwhile, the latest price action also reaffirms that strong support has been established at 1,521.50 pts. As such, we keep to our positive trading bias.

Traders should stick to long positions, initiated at 1,538.50 pts, or the closing level of 23 Sep. To mitigate downside risks, the stop-loss is placed at 1,521 pts.

The immediate support is kept at 1,521.50 pts, or the low of 24 Sep, followed by 1,512 pts or 21 Sep’s low. The nearest resistance is eyed at 1,543.50 pts – the high of 24 Sep – and subsequent resistance at 1,550 pts.

Source: RHB Securities Research - 29 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024