WTI Crude: Continuing to Rise Higher

rhboskres

Publish date: Wed, 06 Oct 2021, 05:24 PM

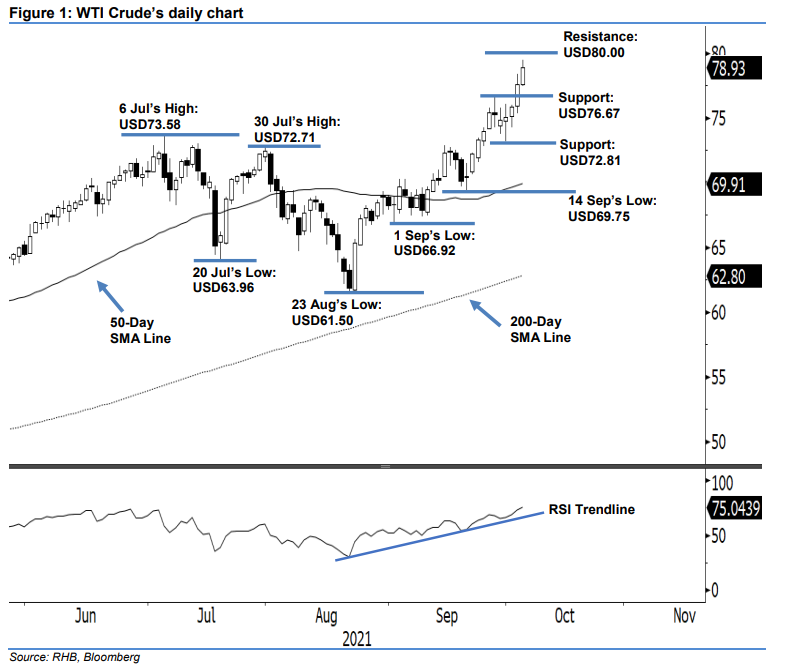

Keep long positions. The WTI Crude persisted its bullish momentum yesterday to futher mark its multi-year highs after climbing USD1.31 to settle at USD78.93 – recording five consecutive bullish sessions. The commodity began on a neutral tone at USD77.58 and oscillated sideways during the half-day session – touching the USD75.32 intraday low. Strong buying momentum emerged following the start of the US trading session, which saw the WTI Crude being propelled to the USD79.48 intraday high before mild correction took place towards the close. The white body candlestick printed following Monday’s breakout session represents the follow through of positive momentum – this may signify the possibility of an intense rally ahead with cautions of a pullback to come. This is supported by the accelerating strength of the RSI towards the 75% overbought level – this may continue its strength before fading weaker. Hence, we stick to our bullish trading bias.

Traders should maintain the long positions initiated at USD67.54, ie the closing level of 24 Aug. To manage risks, the trailing-stop threshold is placed at USD72.81, which was 24 Sep’s low.

The support levels are unchanged at USD76.67 – 28 Sep’s high – and USD72.81, ie 24 Sep’s low. The immediate resistance level is fixed at USD80.00. Ahead of this will likely hit the USD90.00 threshold.

Source: RHB Securities Research - 6 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024