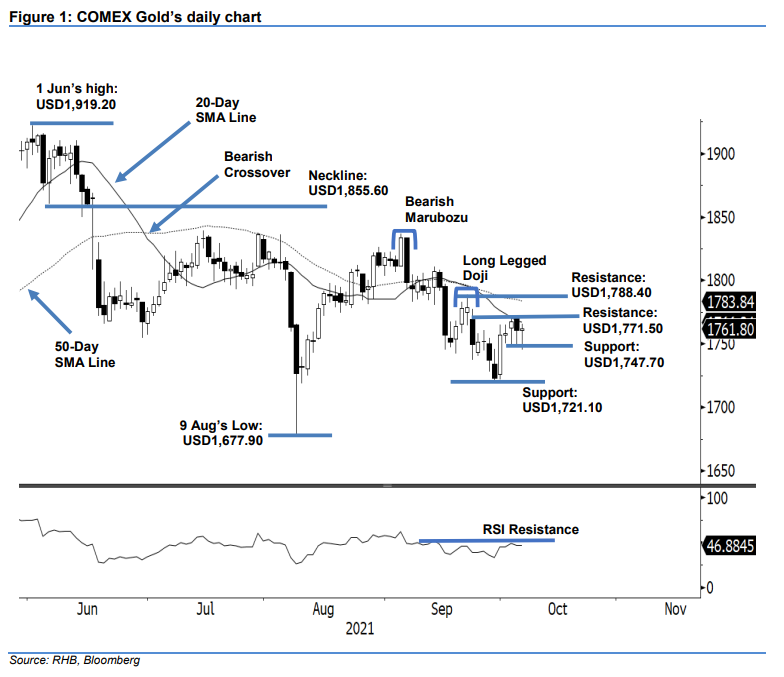

COMEX Gold: Consolidating Near the 20-Day SMA Line

rhboskres

Publish date: Thu, 07 Oct 2021, 08:28 AM

Maintain long positions. The COMEX Gold struggled to cross the 20-day SMA line yesterday, rising a marginal USD0.90 to settle at USD1,761.80. The commodity started off at USD1,760.50 but cautious sentiment dragged it to touch the USD1,745.40 day low. It then rebounded towards the USD1,765.90 day high. The COMEX Gold closed at USD1,761.80 and printed a candlestick with long lower shadow. The latest session showed that the bulls have been defending the immediate support at USD1,747.70 for the past three sessions while the 20-day SMA line is still posing selling pressure on the commodity. With the RSI below the 50% threshold, we expect a weak momentum ahead, whereby the COMEX Gold should continue to trade in the USD1,771.50 and USD1,747.70 range until either boundary sees a breakout. As buying pressure persists near the immediate support, the recent counter-trend rebound remains intact. As such, we continue to stick to our positive trading bias.

Traders should keep the long positions initiated at USD1,767.60, ie the closing level of 4 Oct. Conversely, to mitigate the trading risks, the stop-loss threshold is set at USD1,743.

The immediate support is marked at USD1,747.70 – 4 Oct’s low – and followed by USD1,721.10, or 29 Sep’s low. The first resistance is pegged at USD1,771.50 – 4 Oct’s high – and followed by USD1,788.40, ie 22 Sep’s high.

Source: RHB Securities Research - 7 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024