Hang Seng Index Futures: Counter-Trend Rebound Gaining Traction

rhboskres

Publish date: Fri, 08 Oct 2021, 07:26 PM

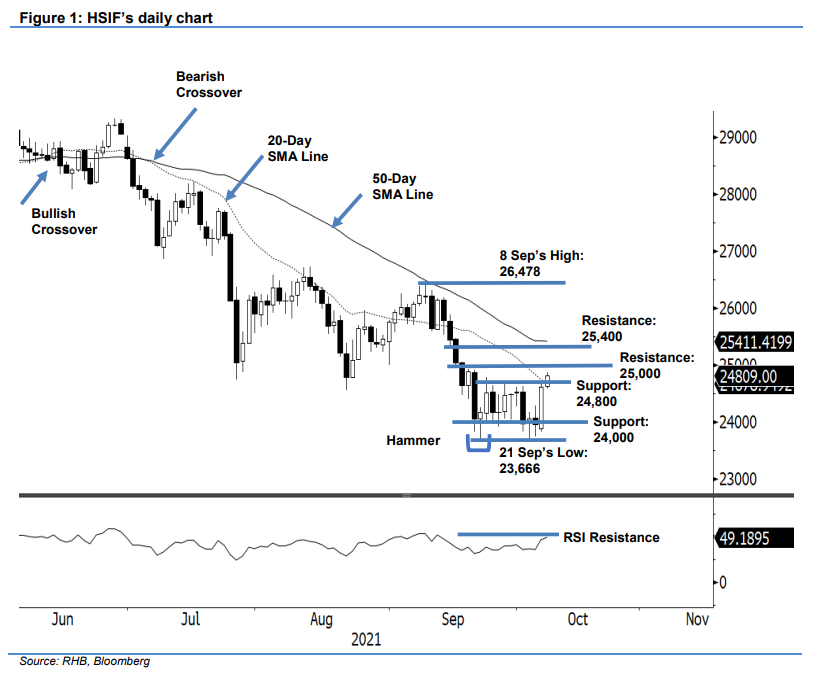

Trailing-stop mark triggered; initiate long positions. The HSIF saw a strong counter-trend rebound yesterday, surging 663 pts to settle the day session at 24,620 pts.The index initially started the morning on a stronger note, gapping up to open at 24,220 pts. The bullish momentum then lifted the HSIF to test the 24,712-pt level before closing the day session at 24,620 pts. During the evening session, it tracked its US peers and climbed above the 24,800-pt resistance. It last traded at 24,809 pts. The latest session saw the HSIF tracking to close the week in positive territory – it is also on its way towards marking a fresh 2-week high. If the index is able to sustain above the 24,800-pt immediate support, the bulls may look to test the 25,000-pt psychological level. Reclaiming the threshold will strengthen the bullish counter-trend rebound. Since the stop loss is triggered, we shift to a positive trading bias.

We closed out the short positions initiated at 25,646 pts – 9 Sep’s day session close – after triggering the trailing-stop mark at 24,800 pts. Conversely, we initiate long positions at the closing level of 7 Oct’s evening session, ie 24,809 pts. To mitigate the trading risks, the initial stop-loss threshold is set at 24,000 pts.

The immediate support is revised to 24,800 pts, followed by the 24,000-pt round figure.The nearest resistance remains at the 25,000-pt round figure, followed by 25,400 pts.

Source: RHB Securities Research - 8 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024