WTI Crude : the Bulls Are Still in Control

rhboskres

Publish date: Fri, 08 Oct 2021, 07:27 PM

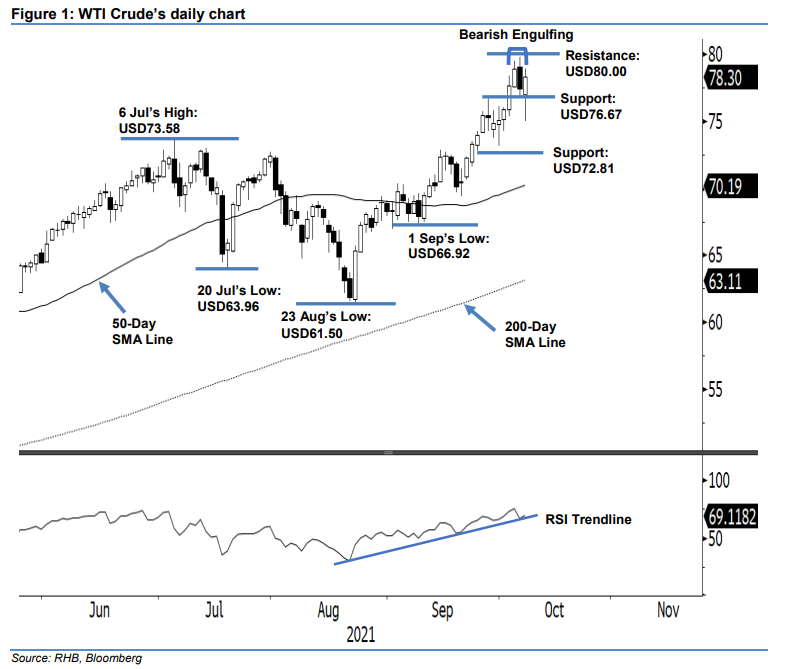

Maintain long positions. The WTI Crude reversed its intraday losses yesterday, climbing USD0.87 to close at USD78.30 – penetrating into Bearish Engulfing territory. The commodity initially started the session on a weaker note, gapping down to open at USD77.00 before falling to the USD74.96 day low. Strong buying interest emerged during the US trading session, which lifted the black gold, allowing it to reach its intraday high of USD78.89 before closing at USD78.30, where it printed a white body candlestick with long lower shadow. The latest session indicates the bulls remain in control and reaffirmed that the USD76.67 level acts as a strong support. As long as the WTI Crude sustains above this threshold, the bullish momentum may continue to propel prices higher. Meanwhile, breaching the immediate support will see the commodity returning to a correction phase. As the bullish momentum remains intact, we retain our positive trading bias.

Traders are recommended to hold on to the long positions initiated at USD67.54, ie the closing level of 24 Aug. For trading-risk management, the trailing-stop threshold is set at USD76.67, which was the immediate support level.

The support levels remain at USD76.67 – 28 Sep’s high – and USD72.81, or 24 Sep’s low. The immediate resistance level is pegged at USD80.00. A higher resistance is projected at the USD90.00 threshold.

Source: RHB Securities Research - 8 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024