FKLI: Bullish Posture Still In Place

rhboskres

Publish date: Fri, 08 Oct 2021, 07:30 PM

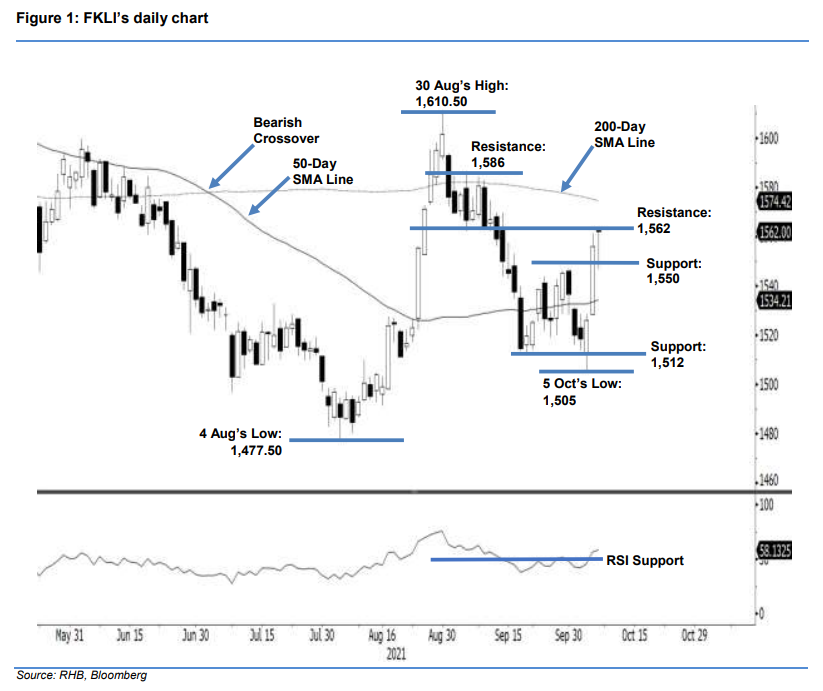

Maintain long positions. Despite the mild selling pressure during the intraday, the FKLI closed 6 pts higher at 1,562 pts yesterday, indicating that the uptrend remains intact. It gapped up at the open, at MYR1,562.50. Profit-taking activities dragged it to the day’s low of MYR1,546,50 pts. Not long after the session started, the index rebounded from the day’s low, and pared down intraday losses before closing. The latest session printed a candlestick with a long lower shadow, reaffirming that the 1,550-pt level will function as a strong support. Meanwhile, as the bullish momentum is picking up pace – evidenced by the RSI crossing above the 50% threshold – the index should cross the immediate resistance of 1,562 pts in the sessions ahead. If this happens, the bulls may try to test the 200-day SMA line. Since the bullish momentum is intact, we make no change to our positive trading bias.

We recommend that traders maintain the long positions initiated at 1,556 pts or the closing level of 6 Oct. To mitigate the downside risks, the stop-loss threshold revised higher to 1,526 pts.

The immediate support is at 1,550 pts, followed by 1,512 pts, ie 21 Sep’s low. Meanwhile, the immediate resistance is pegged at 1,562 pts – 6 Sep’s low – followed by 6 Sep’s high of 1,586 pts.

Source: RHB Securities Research - 8 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024