COMEX Gold: Climbing Above the 50-Day SMA Line

rhboskres

Publish date: Thu, 21 Oct 2021, 04:51 PM

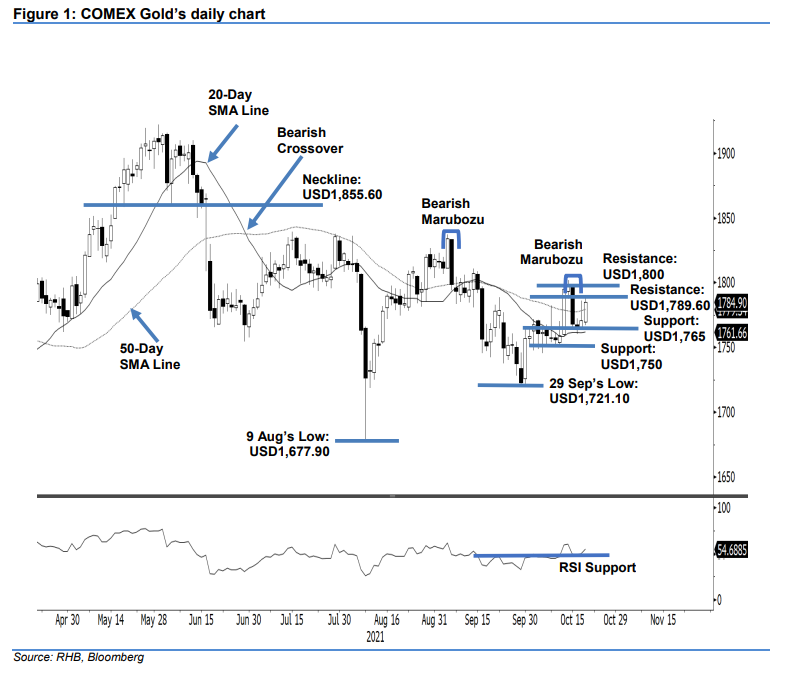

Stop-loss mark triggered; initiate long positions. The COMEX Gold saw the bullish momentum accelerate yesterday, rising USD14.40 to settle at USD1,784.90 – crossing above the 50-day SMA line. The commodity opened at USD1,769.40 and rose higher throughout the session. Although there was mild profit-taking after it reached is intraday high of USD1,789.60, the COMEX Gold managed to maintain its upward trajectory and close in positive territory. The latest session showed the commodity had recouped most of the losses incurred by the Bearish Marubozu on 15 Oct – forming a strong footing at the 20-day SMA line and crossing above the 50-day SMA line. If the bullish momentum follows through, it may test the resistance at the USD1,800 level and negate the bearish candlestick. Since the stop-loss mark has been triggered,we shift to a posiive trading bias.

We closed out the short positions initiated at USD1,768.30 – 15 Oct’s closing level – after the USD1,780 stop-loss was triggered. Conversely, we initiate long positions at the closing level of 20 Oct, ie USD1,784.90 To manage trading risks, the initial stop loss is set at the USD1,750 round figure – a level below the 20-day SMA line.

The immediate support remains at USD1,765 – 30 Sep’s high – and followed by the USD1,750 psychological level. The nearest resistance is pegged at USD1,789.60 – 20 Oct’s high – and followed by the USD1,800 round number.

Source: RHB Securities Research - 21 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024