WTI Crude: Selling Pressure Emerges at the Top

rhboskres

Publish date: Fri, 22 Oct 2021, 05:39 PM

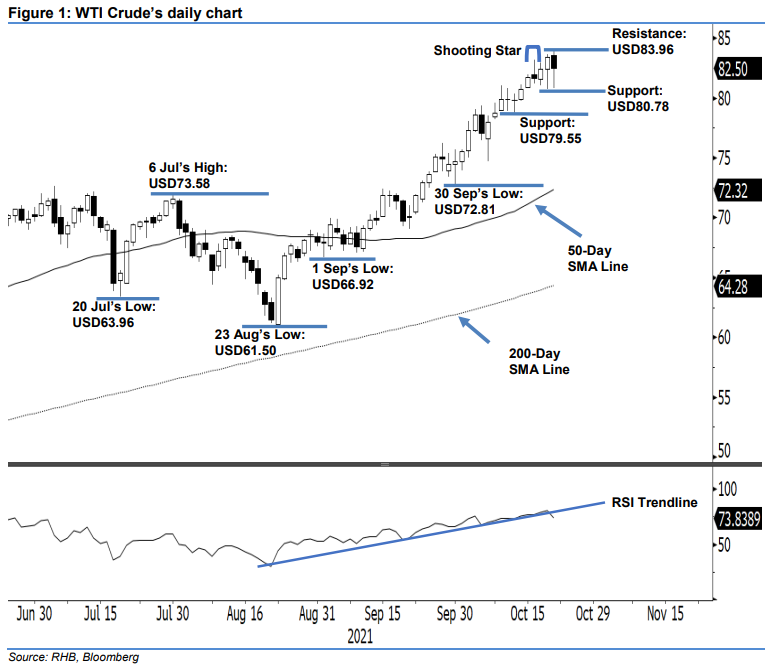

Keep long positions. The WTI Crude displayed negative momentum yesterday, struggling to move higher. It dipped USD0.92 to settle at USD82.50 – near Wednesday’s opening of USD82.46. Although the commodity began the session stronger at USD83.58, positive momentum ended after touching the day’s USD83.96 high, after the Asian trading session. It swiftly reversed south until the end of the session, hitting the day’s low of USD80.79 before partially recouping its intraday losses to close. The latest black body candlestick, which nullified yesterday’s positive momentum, indicates that selling pressure is imminent. Supported by the weakening RSI in overbought territory, profit-taking may be seen in coming sessions. Nevertheless, bullish momentum may be renewed if it manages to surpass the recent high of USD83.96. As it has yet to breach the trailing-stop, we keep our bullish trading bias.

Traders should hold on to the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage trading risks, the trailing-stop threshold is revised higher to USD80.78.

The support levels are set at USD80.78 – 20 Oct’s low – and USD79.55, or 11 Oct’s low. The resistance threshold is pegged at USD83.96, or 20 Oct’s high, followed by the USD90.00 round number.

Source: RHB Securities Research - 22 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024