WTI Crude - Poised to Move Past the Top

rhboskres

Publish date: Mon, 25 Oct 2021, 10:58 AM

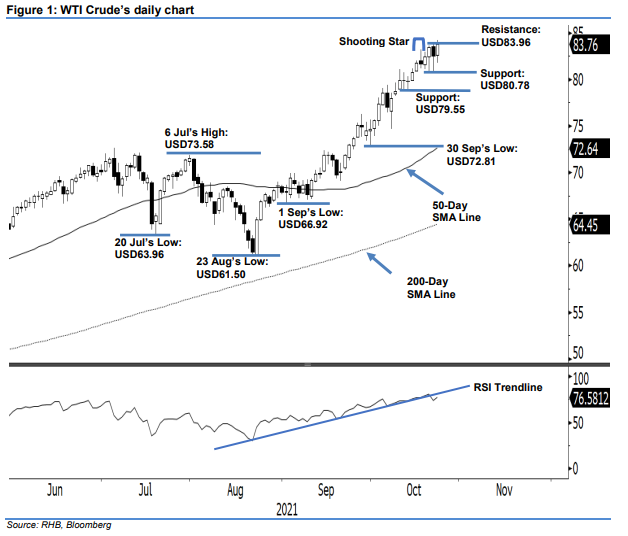

Keep long positions. The WTI Crude reversed its momentum to a positive one as it attempted to breach the immediate resistance last Friday – it bounced off USD1.26 higher to settle at USD83.76. The commodity began the session in a positive tone at USD82.61 before whipsawing in a mildly downward fashion to hit the day’s bottom at the low of USD81.76. Then, strong buying interest emerged to steer the WTI Crude northwards, which saw it hit the day’s peak at USD84.22 before the close. The latest white body candlestick that closed above Thursday’s opening suggests the positive momentum has been renewed. Nevertheless, the leading indicator RSI is showing a divergence trend relative to the price. With that, we expect the bullish momentum in the short term to be shortlived ahead of strong profit-taking activities. As such, we keep our bullish trading bias until the trailing-stop level is triggered.

Traders should maintain the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage trading risks, the trailing-stop threshold is set at USD80.78.

The support levels are pegged at USD80.78 – 20 Oct’s low – and USD79.55, or 11 Oct’s low. The resistance threshold is set at USD83.96, ie 20 Oct’s high. This is followed by the USD90.00 round number.

Source: RHB Securities Research - 25 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024