Hang Seng Index Futures - Consolidating Near 26,000 Pts

rhboskres

Publish date: Mon, 25 Oct 2021, 10:59 AM

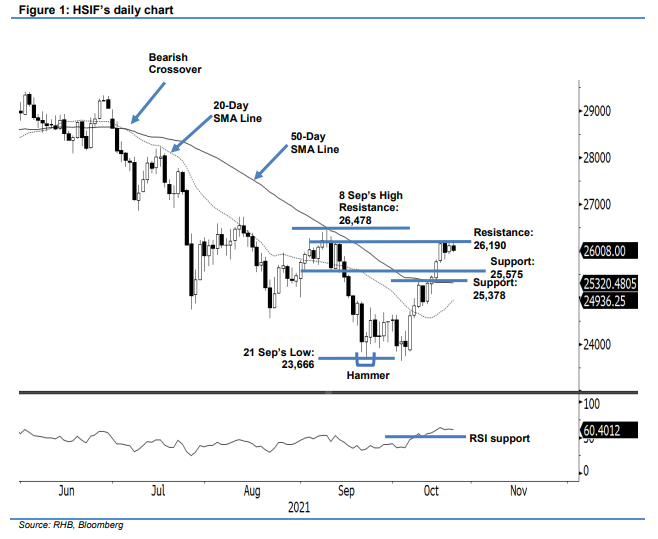

Maintain long positions. Despite mild profit-taking, the HSIF managed to maintain its bullish posture, staying above the psychological threshold of 26,000 pts. On Friday morning, the index opened stronger at 26,155 pts. After oscillating between 26,174 pts and 25,952 pts, it settled the day session at 26,110 pts. It retreated 102 pts during the evening session, and was last traded at 26,008 pts – retaining its position above the 26,000-pt level. The index saw a narrow trading range on Friday, with the bulls and bears at equal strength. Following the strong rally, since moving past the 20-day SMA line, the index is due for a consolidation before staging a fresh attempt to test the upside resistance. If it pulls back on profit-taking, we expect downside support to be found near the 50-day SMA line. We stick to our positive trading bias until the trailing-stop is breached.

Traders are recommended to hold on to the long positions initiated at 24,809 pts, or the closing level of 7 Oct’s evening session. For risk management, the trailing-stop threshold is fixed at 25,250 pts.

The nearest support stays at 25,575 pts – 1 Sep’s low – followed by 25,378 pts, which was 19 Oct’s low. The immediate resistance remains at 26,190 pts – 13 Sep’s high – followed by 26,478 pts, or 8 Sep’s high.

Source: RHB Securities Research - 25 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024